The Chinese luxury travel market is booming, and all signs point to it continuing its rise. First, there’s the fact that the general Chinese outbound tourism market growing. Then, take into account that Chinese consumers account for 30 to 50 percent of all luxury sales. Moreover, the number of Chinese high net-worth individuals (HNWI) is also growing – the Hurun Report’s recently released study, the Chinese Luxury Traveler 2017, reveals a 14.1% year-on-year increase in the number of yuan billionaires, compared to overall Chinese population growth of 10.7%. These trends indicate a perfect storm for growth in the Chinese luxury travel market, and further analysis shows a wide range of opportunities that these market developments are creating.

1. Shopping

Experiences and aspects of travel that are unrelated to shopping are becoming increasingly important to China’s luxury travelers, while at the same time, the average Chinese tourists’ per capita shopping decreased by 40,000 yuan from 2015 to 2016. That said, shopping by HNWI Chinese travelers is still booming. The Hurun Report uncovered a 57% year-on-year increase in money spent shopping overseas among HNWI Chinese, from 14 million yuan per capita up to 22 million. Shopping is a particularly important part of travel for female HNWI travelers, and the most popular purchases include cosmetics, local specialties, clothing, jewelry and luggage.

Attracting these high-end customers overseas starts with a good China-based marketing strategy, as most Chinese travelers research and plan their overseas purchases ahead of time. Brands should take advantage of all WeChat has to offer – for example, Louis Vuitton runs a service account that can advise followers on their nearest shop, and luxury jewelry brand Chow Tai Fook has a WeChat-based loyalty center for members to check their points, as well as a WeChat-hosted shop connected to the WeChat Wallet payment system.

Weibo is also important for luxury brands, and a good place to do partnerships with Key Opinion Leaders (KOLs). It’s also important to stay up to date on the newest platforms – a recent L2 study on luxury and digital tools revealed that brands are moving away from traditional video hosting site Youku towards newer, short video platforms like Miaopai. Here again, partnering with KOLs can bring fantastic results: Bulgari got 24.8 million views on live streaming platform Yizhibo for the launch of a new watch because it included an appearance by Chinese pop star Kris Wu, and Folli Follie multiplied its Tmall sales by five when it held a live streaming event with 30 Chinese KOLs.

KOL Kris Wu in live streaming with Bulgari CEO

2. Experiences

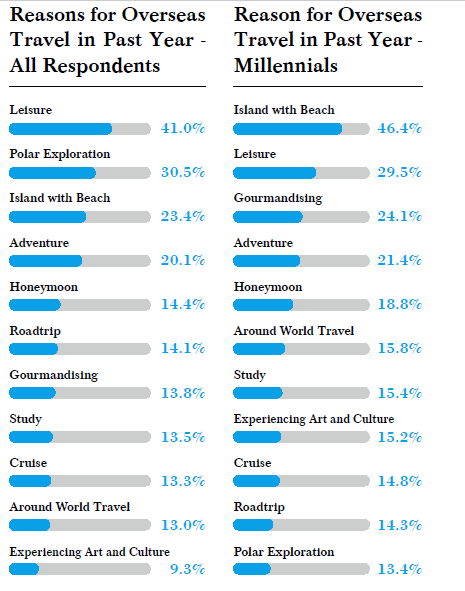

Despite the enduring importance of luxury shopping among high-end travelers, there is a trend towards buying unique and enviable experiences rather than just material possessions. This relates to both activities and destinations. In terms of activities, there’s a trend towards nature, adventure and sports tourism, which includes things like diving, skiing and golf. Skiing, in particular, is drawing increasing numbers of wealthy Chinese to destinations like Japan, South Korea, Canada and Switzerland. As Chinese luxury travelers tend to be experienced, with 45% having visited more than 20 countries, according to the Hurun Report, there is also growing interest in far-flung, niche destinations. This is especially pronounced for Antarctica, as well as Africa, and is also evident in the kind of target market and brand positioning of other niche destinations such as Peru.

If you are promoting a niche travel destination, don’t forget that targeting affluent Chinese travelers may get you a much broader audience in the future. The travel market has seen a trickle-down effect, with HNWI as trail blazers, and others following suit – one good example of this is the Maldives, once favored especially by luxury travelers, and now a hot destination for Chinese tourism in general.

3. Accommodation

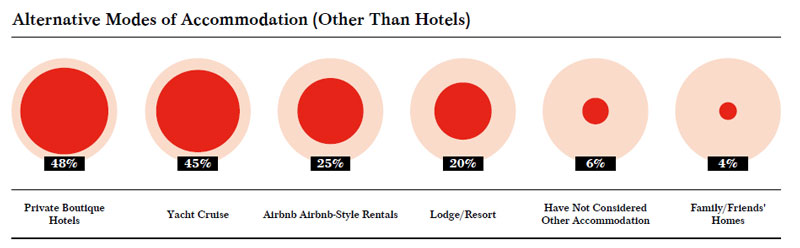

Luxury Chinese travelers have large and growing budgets for accommodation, with an average of 3,800 yuan (US$559) per night, according to the Hurun Report. Moreover, price is not even a particularly important factor for these HNWIswhen choosing accommodation, with personalized service, quality and location all ranked more highly. And while big-name brands like Ritz-Carlton are still the most popular with affluent Chinese travelers, there is growing interest in and opportunity for boutique hotels. Marketing here would do well to focus on lifestyle content, featuring things that interest Chinese HNWIs such as health and wellness, and promote aspects of the hotel that particularly appeal to the Chinese high-end market, like good views, service and in-house dining.

Hurun Report 2017

4. Food

Food is particularly important for Chinese millennials, with 24.1% choosing gourmandizing as one of their top travel priorities, according to the Hurun Report. This creates new opportunities for destination marketing – in fact, luxury dining experiences are one of the key elements in Peru’s newly launched Chinese tourism campaign – as well as for hotels and restaurants. Alongside fine dining, wine tasting has also been pegged by the Hurun Report as a future trend for luxury Chinese tourism. This creates excellent opportunities for destinations on nearly every continent, and concierge travel companies that don’t already do so should consider adding gourmet tours and restaurant booking services, as well as wine- and even spirit-tasting activities if available, to their repertoires.

Hurun Report 2017

5. Travel services

As large tour groups lose their appeal among the Chinese, especially at the higher end of the market, they are not simply being replaced by independent travel. There is significant interest among affluent Chinese travelers in custom-designed travel services, which could be provided by dedicated luxury branches of travel agencies, or by concierge services that recommend and arrange personalized travel itineraries. This creates opportunities both for travel agents and agencies inside of China, as well as for boutique travel providers overseas that want to target the Chinese market.

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.