Now in its 22nd year, the 2026 Hurun Chinese Luxury Consumer Survey was released on 30 January. The report is based on a survey of 470 HNWI Chinese and covers a wide range of consumer preferences, including shopping, dining, drinking, health, family life, investments, and travel.

Overall, the survey results highlight the relative strength and resilience of travel as a consumption category for wealthy Chinese, echoing the Chinese economy in 2025 as a whole – where the growth in spending on travel and sightseeing far surpassed other goods and services. These are our top six takeaways from the report, all relating to travel and digital content.

You can read the full report in English on Hurun’s website here. Data charts are available in Chinese only, and you can find those here (we’ve translated a few below).

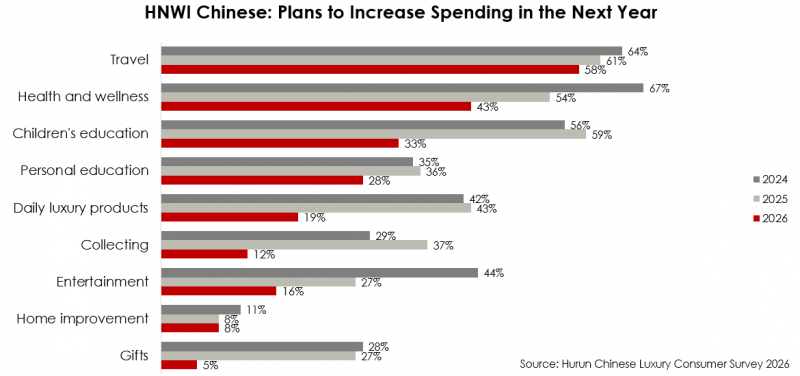

1. Travel is once again the no. 1 category on which Chinese HNWIs plan to increase spending

In the 2026 survey, 58% of respondents said they planned to increase spending on tourism, making it the no. 1 category for the second year in a row. The next most prioritized categories were health and wellness (43%) and children’s education (33%). Although the percentage planning to increase spending on travel declined slightly from 61% in 2025, most other categories saw bigger drops. Hurun’s survey results also show fairly even age distribution among those saying they would increase spending on travel, from the under-25 segment to the over-45s all planning to spend more on travel.

The survey revealed that planned spending on consumer goods categories such as cars, jewelry, clothing, and alcohol decreased by 10.2% in 2026 compared to 2025. In contrast, planned annual spending on services and experiences was up by 12.4% year on year. Survey respondents planned to spend RMB266,000 (US$38,342) on entertainment and travel in 2026, up 17.7% compared to last year.

The survey revealed that planned spending on consumer goods categories such as cars, jewelry, clothing, and alcohol decreased by 10.2% in 2026 compared to 2025. In contrast, planned annual spending on services and experiences was up by 12.4% year on year. Survey respondents planned to spend RMB266,000 (US$38,342) on entertainment and travel in 2026, up 17.7% compared to last year.

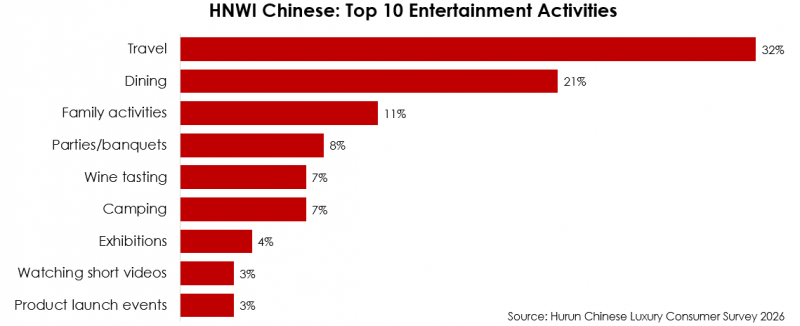

2. Chinese HNWIs are more likely than ever to say travel is their favorite leisure activity

For the third year in a row, Hurun’s survey respondents named travel as their top leisure activity, chosen by 32% – a healthy increase from last year. The next-most popular leisure activity was dining (21%) and family activities (11%), both also increasing since last year.

3. The Maldives remains a favorite destination – but Iceland is becoming more popular

Although this year’s report doesn’t include a ranking chart as in past years, it lists the top five international destinations for HNW Chinese as the Maldives, Switzerland, France, Japan, and New Zealand. This would be the third year in a row that the Maldives top Hurun’s list. Interest in traveling to the US has declined, says the report, while the ranking for Iceland continues to rise – it came in 6th this year, up from 13th place last year. Dragon Trail’s consumer and trade surveys have also highlighted growing interest in Iceland as a travel destination in recent years. Hurun’s survey respondents traveled overseas an average of 2.1 times last year.

4. Chinese luxury travelers are seeking sun and sea – not shopping

Sun and sea was the most popular travel theme for Hurun’s survey respondents this year, up from 2nd place last year, and chosen by 17.3% – an impressive increase of 5.5 percentage points. The next most popular theme was luxury resorts with 14.2% (up 3.4 percentage points more from last year), followed by 2025’s top theme, historical heritage. Shopping, which ranked as the top travel theme back in 2023, has slipped to 10th place, chosen by just 3.8% of respondents (down by 3.4 percentage points).

5. More than half of wealthy Chinese are going on international business trips

62% of Hurun’s survey respondents traveled outside of mainland China on business last year. The most frequently visited destination was Hong Kong (45%), followed by Singapore/Malaysia/Thailand (31%). 30% traveled to the US on business, with 25% going on business trips to Europe and 21% to the Middle East.

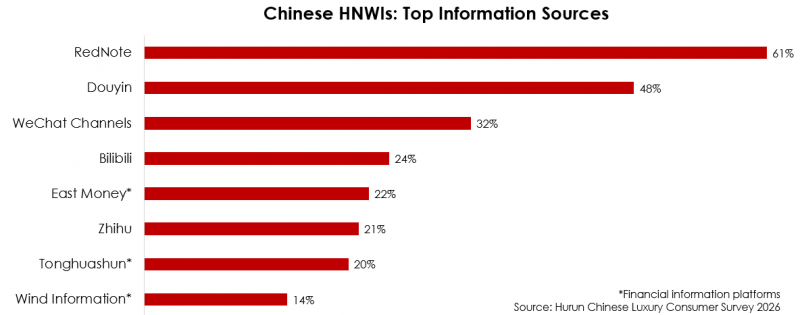

6. RedNote is the leading information source for Chinese HNWs

Wealthy Chinese are most likely to turn to RedNote/Xiaohongshu for information – the platform was chosen by 61% of total respondents, and by over 70% of those under the age of 25. Douyin comes in second, with 48%. The third most used information source – and most popular with respondents aged 35 and older – is WeChat (32%).

You can read the full Hurun Chinese Luxury Consumer Survey 2026 in English on Hurun’s website here. Data charts are available in Chinese only, and you can find those here.

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.