Despite limitations around outbound travel and safety concerns around COVID, Chinese consumers’ desire for travel persists. Preferences for destinations remain strong despite relatively low safety perceptions.

According to Dragon Trail’s September 2021 sentiment survey, over 81% of Chinese travelers react favorably when they see information about outbound destinations. But at the same time, safety perceptions for outbound destinations remain underwhelming.

As 2021 is coming to an end, the travel industry has battled through almost two years of COVID-19. How have travelers’ destination preferences changed? What are their priorities for post-pandemic outbound travel?

Dragon Trail’s China Travel Market Monitor collects insights from more than 1,000 Chinese outbound travelers. In November, we surveyed 1,027 travelers about their priorities and preferences. Here are the results.

Want to run a survey with your own questions via Market Monitor? Click here to get started.

Click here to download the results as a PDF

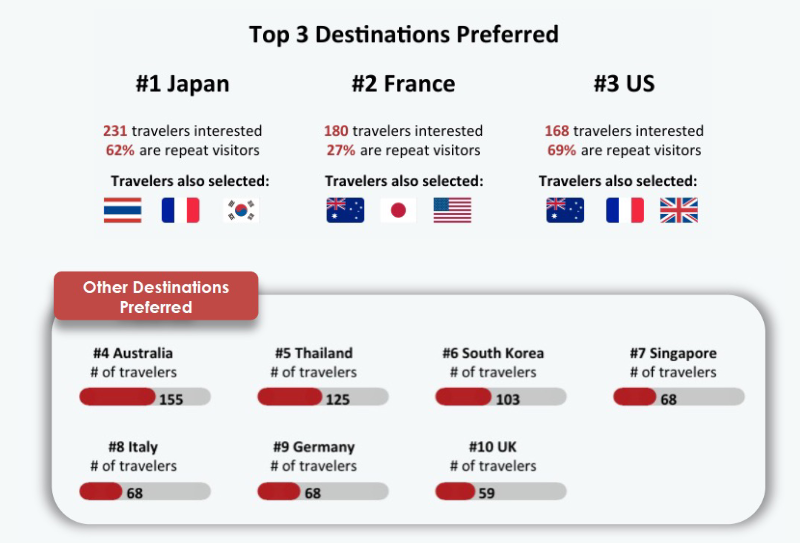

1. First Post-COVID Travel Destination: Interest Spreads Across Regions

Despite persistent safety concerns around COVID cases, Japan, US and Australia are highly preferred for post-pandemic travel. Japan and the US were notably identified by survey respondents as the least “safe” destinations in previous research, but safety perceptions might not influence travel decisions in the long run.

Travelers’ top 10 preferred outbound destinations were widely spread across regions, with four destinations in Asia, four in Europe, one in the Pacific, and one in North America.

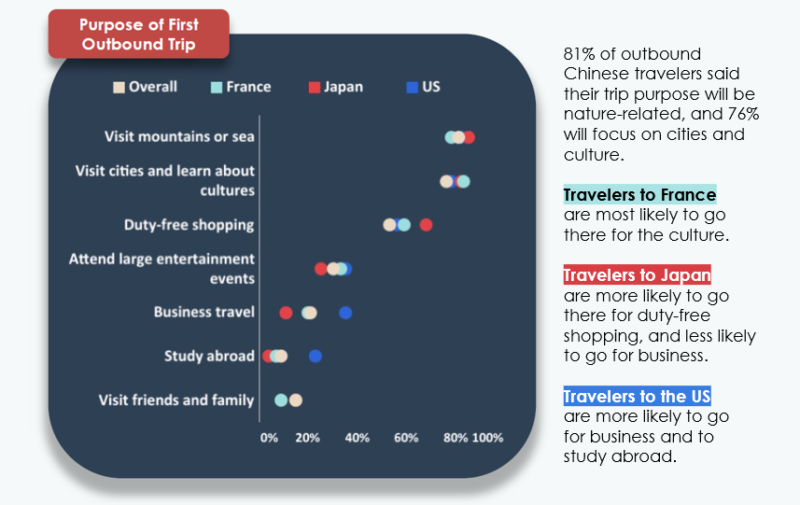

2. First Outbound Trip Purpose: More Than Nature And Culture

From an overall perspective, post-pandemic travel purposes will center on nature and culture tourism. This rings true for all three destinations most preferred by Chinese outbound travelers.

For each destination, we see a clearer picture of different trip purposes from travelers interested to visit.

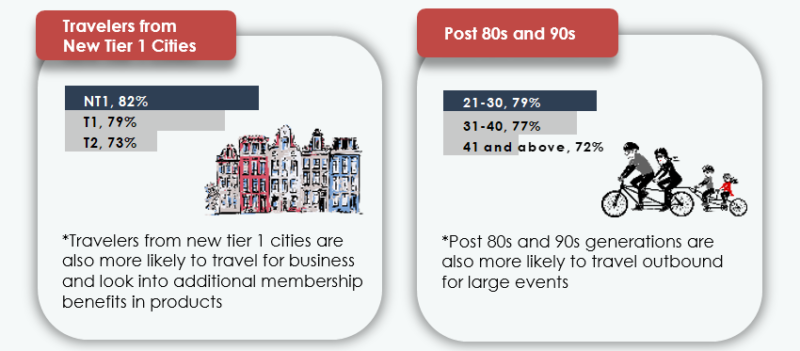

3. Outbound Traveler Profile: Young, New Tier 1 City Travelers

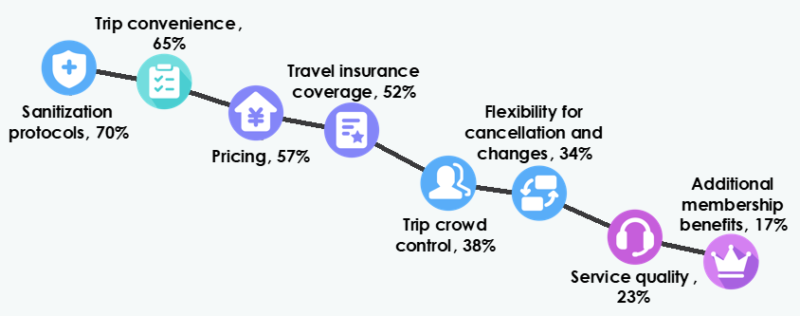

4. Product Preferences: Safety > Convenience > Pricing

DATA

China Travel Market Monitor

Contact us to join next month: info@dragontrail.com

ICONS

Iconfont via www.iconfont.cn

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.