Cover photo: Gaddafi Rusli, Unsplash

Chinese outbound travel has restarted, and major international travel industry events are returning to the country. In this first year of post-pandemic recovery, what is the mood among Chinese travel agents? For overseas destinations and travel suppliers, what is the best way to work with the trade in 2023, and which products are most in demand? Between 7 June-3 July 2023, Dragon Trail Research explored these questions in a survey of mainland Chinese outbound travel agencies.

Click here to view and download the full report

(Users in China: if you cannot open the above link, please contact us directly to receive your copy of the report)

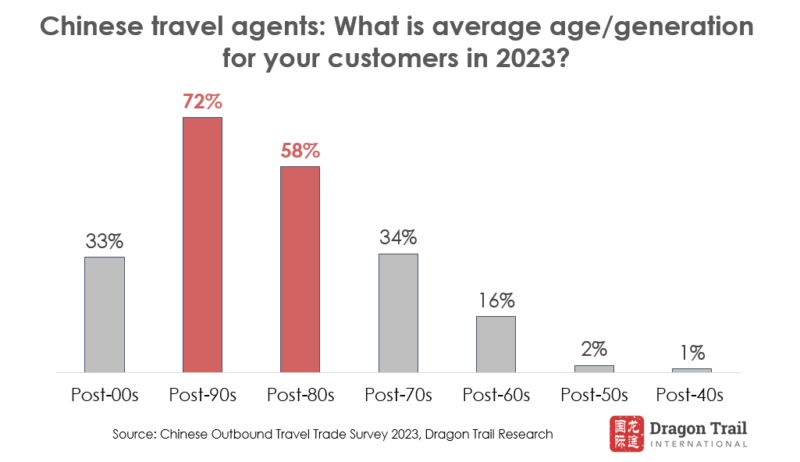

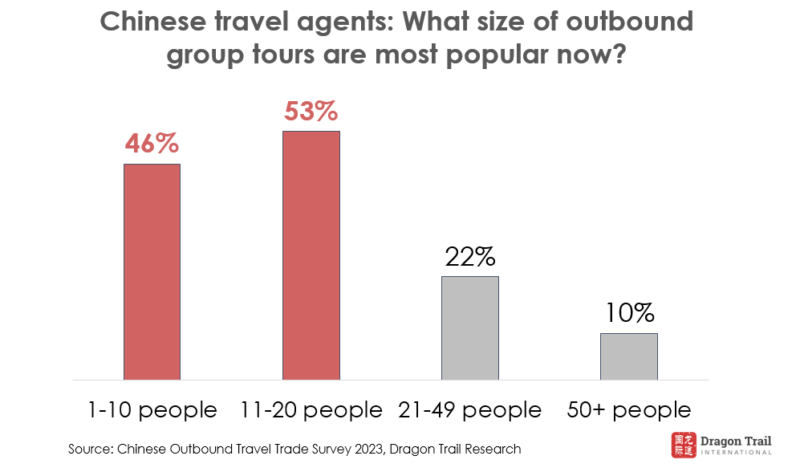

Our survey results provide an overview of the overall Chinese outbound travel market, with practical applications for product development. FIT is considered the most popular travel product as sold by travel agents in 2023, and group tours are best limited in size to 20 or fewer travelers. Perhaps related to these trends is the fact that the market is young, with millennials born in the 1990s and 1980s the core customer group for Chinese travel agents selling outbound trips.

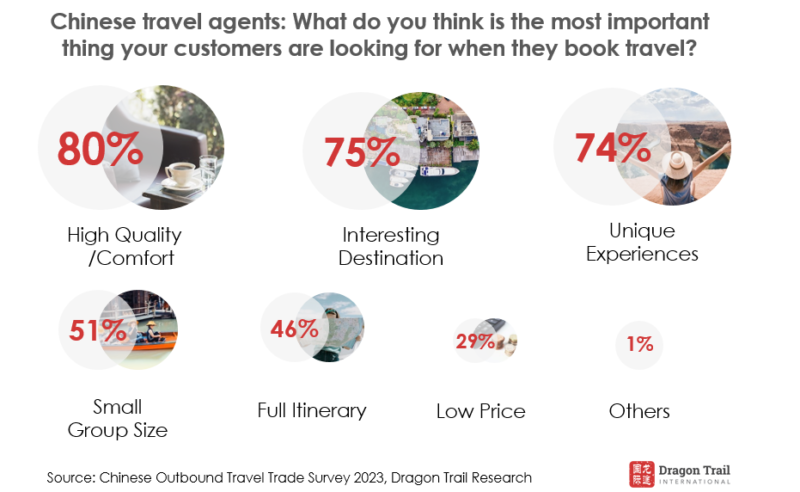

Are there any changes in customer demand? What do travel agents say their clients value the most when choosing a travel product, and what themes do they prefer? Quality and comfort, interesting destinations, and unique experiences rank much higher than low prices. Among travel themes, beach and island, and family trips are the most popular options.

The full recovery of the outbound Chinese travel market still faces significant obstacles, among which visa applications and high prices are the most onerous, according to the travel trade. Still, our respondents are eager to meet international partners once more, with offline events chosen as the most helpful way to receive information from overseas destinations and businesses. At the same time, online platforms should not be overlooked, especially WeChat. More than half of respondents said online training courses and live webinars were the most useful resources for them when dealing with overseas destinations.

These are our 8 recommendations for B2B engagement, based on the survey’s findings:

1) It’s time to meet in person…

During the pandemic, some questioned whether in-person events and meetings would ever return. The answer from the Chinese travel trade is a resounding “yes.” 61% said that meeting at an offline event would be their preferred way to work with overseas travel destinations and businesses, while 70% said they are currently making sales to consumers at in-person events – the leading sales channel.

2) …and invest in online training

At the same time that offline events are of renewed importance to the Chinese travel trade, digital channels are also vital to both training and sales. 56% of travel agents said that online training courses and live webinars would help them to work with overseas suppliers. Digital channels – particularly WeChat – are also popular for travel agents making sales to their clients.

3) The millennial market dominates travel trade sales in 2023

Don’t assume that Chinese consumers who purchase travel through agencies are older than the overall outbound travel market. In fact, post-90s travelers are driving travel agent business in 2023, followed by the generation born in the 1980s. Whether you’re engaged in B2C or B2C travel marketing and sales, it is important to take the behavior and demands of Chinese millennials into account.

4) Focus on independent and small group travel

With the number of countries where Chinese travel agents can sell group travel products still restricted to less than half of pre-pandemic levels, bookings for independent travelers are considered the most popular product type by 42%, ahead of group tours (34%) and customized travel for private groups (24%). Group sizes are also small, with groups of 20 people or fewer the most popular.

5) Natural settings, family travel, and special experiences are selling best

Travelers value experiences, relaxation, nature, and family time in 2023. According to travel agents, beach and island (37%) is the leading travel theme, followed by family travel (33%). Nature, arts & culture, and adventure/sports are also popular themes for travel products booked through an agency.

6) Quality and experiences are valued over low prices

When asked about what their customers value most when booking travel, travel agents overwhelmingly chose the quality of products and experiences offered in destination over low prices.

7) Visas and travel costs are the leading obstacles to recovery

China reopened more than six months ago, but there are still obstacles impeding the travel trade’s recovery. The top barriers to selling outbound travel are difficulties in getting visas and high prices, especially airfares.

8) Chinese-language communications should be prioritized

When it comes to materials and communications from overseas destinations and tourism suppliers, Chinese travel agents strongly prefer to use Mandarin. More than half are happy communicating in English, but it’s very rare they’ll be comfortable doing business in other foreign languages.

Dragon Trail’s B2B marketing services include digital solutions such as training courses and live webinars; trade representation; and a full range of event management, including offline, hybrid, and digital events and FAM trips. Click here to learn more, or contact us to discuss how we can connect you to the Chinese travel trade.

About this report

The Chinese Outbound Travel Trade Survey is published by Dragon Trail Research (a division of Dragon Trail International), based on our own survey of 101 travel agents currently selling outbound travel for mainland Chinese travel agencies. In addition to trade and consumer reports, Dragon Trail Research also offers a number of services to travel brands and businesses, including bespoke consumer and trade surveys, focus groups and more. Please click here or contact us for more information on how we can help you get the information you need on China’s travel market.

About Dragon Trail

Dragon Trail Research is a division of Dragon Trail International, an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors. Since 2009, our international team of digital solutions and marketing specialists has been helping leading brands around the world to become more globally connected and competitive. Our clients span the travel, MICE, education, and trade sectors, including national and regional destination marketing organizations, event organizers, international organizations, hotels, airlines, cruise lines, attractions, retailers and more.

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.