Chile (pictured) doubled its Chinese arrivals between 2015-2017 (Photo by Sienna Parulis-Cook)

South America is one of the least-visited regions of the world for Chinese tourists. But a combination of interest from China’s most experienced, intrepid travelers, and recent attention towards the Chinese market from South and other Latin American destinations is putting this “last continent” on the map.

This report includes an overview of Chinese tourism growth in South America and the reasons behind it, a market profile of Chinese visitors to South America, advice on marketing strategy for Latin American destinations, as well as some of the biggest opportunities and challenges.

Destinations

Due to logistical challenges and historical visa issues, South America has not developed as quickly as other destinations when it comes to the Chinese tourism market. Most Chinese tourists traveling to South America visit Brazil, Argentina and/or Chile, but other countries are seeing significant and sustained growth as well.

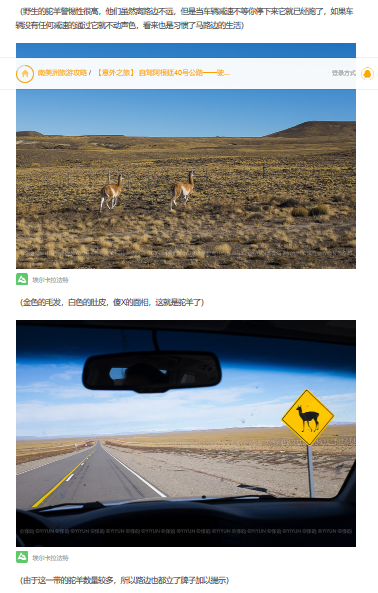

Compared to 2015 arrivals, Argentina saw an increase of 74% in Chinese travelers in 2017, and Chile doubled its Chinese arrivals. Peru’s Chinese arrivals grew by 112% from 2015 to 2018, and Panama tripled its number of Chinese travelers in the same period. Meanwhile, 15% more Chinese travelers visited Brazil, and 50% more were forecast to visit Cuba in 2018.

The Valley of the Moon, located outside San Pedro de Atacama, a popular destination for visitors from mainland China and Hong Kong to Chile (Photo by Sienna Parulis-Cook)

As of 2019, there are no direct flights connecting China and South America. However, the other key to rapid tourism growth – visa reform – is making a major contribution to these numbers. Ecuador has had a visa exemption policy for Chinese nationals in place since March, 2016. Chile, Cuba, Panama, and Peru all waive visas for Chinese passport holders who hold US, Canadian, UK, Australian and/or Schengen visas. In June, 2017, Argentina launched a 10-year multiple entry visa for Chinese passport holders, and Brazil also started to offer Chinese nationals five-year multiple entry visas in October, 2017.

Furthermore, there’s also the rise in Chinese travel to Antarctica – from 37 visitors in 2004 to more than 8,000 in the winter season 2017/2018. China is now the world’s second biggest source market for Antarctic travel, and most will get there via South America, usually incorporating travel in South America as part of an Antarctic trip.

Generally speaking, Chinese travelers like to combine several Latin American countries in one trip, due to the distance of the destination. For example, there are tour packages that pair Peru with Argentina, Brazil and Chile, or two-country packages for Peru-Ecuador, Peru-Bolivia, Peru-Chile, Bolivia-Argentina, or other combinations.

While this is typical for tour packages, FITs might decide to stick to single-country itineraries, because of the large size of most South American countries, as well as time limitations on annual leave for Chinese travelers. The few Chinese tourists that we spoke to in Chile over the Chinese New Year period in 2019 were focusing only on Chile (including Easter Island) for their trips, with past experience or future plans to also visit Argentina on its own.

Market Profile

The high price and long flight times between South America and China favor travelers with ample financial resources and longer vacation time. Chinese tourists to South America are primarily high-end travelers aged between 40 and 65, who are rich in money, time, and travel experience.

However, younger Chinese are also becoming more interested in South America as an exotic, novel destination. Daniel Verástegui, from the Bolivian tourism board, reported that Chinese visitors to Bolivia are most likely to be in the 20-34 age bracket. No matter their age, Chinese visitors to South America will be well-traveled and adventurous. “I’ve already visited Asia, Europe, and North America,” explained Zoe, a young Chinese woman from Guangzhou who spent two weeks traveling through Chile by herself during the 2019 Chinese New Year holiday.

Zoe, from Guangzhou, traveled independently in the north of Chile and to Easter Island

The combination of the travel experience, flight connections, and financial resources needed to get to South America from China means that these visitors primarily come from first-tier cities such as Beijing, Shanghai, and Guangzhou.

The fact that Chinese travelers are relatively unfamiliar with South America, unlikely to speak Spanish or Portuguese, often older, and necessarily wealthy, means that small group travel is a popular way to visit the continent. This can range from a couple or small group of friends traveling together on a customized tour, to a group of up to 20 people.

The flip side is that Chinese travelers to South America are the most experienced and adventurous group of tourists there is, and this may make them confident enough to travel independently – in addition to Zoe, the solo female traveler we met in Chile, we also talked to a middle aged couple from Shanghai who had just set out on a self-driving trip around the country. Despite speaking no Spanish and very little English, they’d done a similar trip to Argentina the year before, and were eager to explore more of South America on their own.

Marketing

The segmentation of the Chinese tourism market to South America calls for a well-organized B2B and B2C marketing approach. The key in both cases is to raise awareness and provide a lot of information to both potential travelers and travel agents – this includes not just information on the destination and attractions, but even more basic education on visa policies, as many agents and potential visitors might be unaware of the recent visa reforms that makes South America an easier place to travel.

Peru is an excellent example of a South American country that has done very extensive work with both the travel trade and reaching and inspiring consumers directly. Please refer to our past articles for full details of their B2B and B2C strategies.

Peru invited two Chinese influencers to spend two weeks traveling around the country with a video team. Read more about the KOLs’ trip and resulting videos here.

Fam trips are an important part of spreading awareness, and enabling Chinese travel agents to effectively and proactively sell South America as a destination to their clients. “There’s a challenge of the agents understanding the destination,” explains Guillermo Fernández, Director of South American DMC Abax Travel. Likewise, fam trips for media, travel bloggers and KOLs can inspire consumers and help put South America on the map in the minds of potential visitors.

When working with the Chinese travel trade, we would also recommend providing an educational program, such as Dragon Trail’s WeChat-based CTA training program and webinars. As a destination and/or tourism provider, you should be prepared to be extremely flexible when arranging trips for Chinese clientele. Especially as these will be wealthier Chinese who are more likely to opt for customized tours than off-the-shelf products, tour operators should expect to modify their products to suit the clients. “I’ve had three appointments with Chinese buyers, and they all have very specific needs,” said George Horney, Tourism Director at Chilean tour operator Latitud 90, at WTM London 2018.

B2C marketing may also be helpful for Chinese travel agents as well as for inspiring consumers – having an official WeChat account, like Argentina, Colombia, Panama, and Peru all do, not only puts information into the hands of the consumer, but can also be used by the trade. Video marketing can be very effective for introducing a new destination, and Peru worked with two Chinese KOLs in 2018 to produce both long and short videos, with plans to do more KOL marketing in the future. An Ecuadorian tourism board professional also told us about a series of Youku videos created by a tour operator there, which could be easily shared with agents and seen directly by travelers.

This travel diary of a self-driving trip through Argentina has received over 72,000 views on Mafengwo

If not working with an agent, how do Chinese travelers plan their trips to South America? Zoe used a combination of the Lonely Planet Chinese-language guide, and reviews and travel diaries on Chinese travel websites Mafengwo and Qyer. She also chose Chile as her destination country based on her understanding that a relatively high number of other Chinese women had traveled there alone before, and that it was therefore safe to do so. Working with Chinese guests and/or KOLs to get more reviews and travel diaries up on these websites, as well as potentially doing paid promotions, is an effective way to reach younger and more independent travelers.

Opportunities and Challenges

South American destinations and tourism businesses have been slowly becoming prepared for and marketing to China for some time already, and the results are already obvious. As more of China’s most experienced travelers start to look for their next destination, seeking out new experiences that will set them apart in their peer group and introduce them to a new part of the world, there’s great potential for prolonged growth.

Continued education, and greater exposure in the media and online will continue to raise awareness and the attractiveness of South America for Chinese travelers. The diversity of landscapes, from deserts to the rainforest, is one major draw. South American food is another area that can be used effectively in marketing, and – one step further, wine tourism also has potential. Although first-time visitors to South America “focus on the highlights,” explains Horney, “wine is the next thing.” The wealthy, internationalized Chinese who are likely to visit South America are also most likely to have an interest in wine, and here, Chile, Argentina and even Bolivia could all do more to market wine tourism to Chinese visitors.

Chile (pictured) and other South American countries have strong potential for marketing wine tourism to a Chinese audience (Photo by Sienna Parulis-Cook)

One primary challenge for South American destinations is Chinese tourists’ tendency to be very risk averse and worried about safety. Media coverage of incidents such as the February 2019 robbery of a Hong Kong tour group at their hotel in Peru will certainly not help in this area, nor will the ongoing political instability in Venezuela. Education is the key to assuaging fears here, and much can be done to inform Chinese travel agents, who will be on the frontlines of dealing with worried customers. Providing clear information and advice about the distance between your destination/location and any questionable areas is a first step, as well as offering clear information on which areas are especially safe. Santiago, Chile, for example, plays up its designation as “the safest city in South America” in English-language tourism materials, and a similar approach is recommended in Chinese. Giving actionable, straightforward advice on safety precautions will also help Chinese visitors to feel more prepared and reassured.

A lesser challenge, but one we’ve seen come up several times, is Chinese fear of altitude sickness, especially among older visitors. If you do work in or around high-altitude areas of South America, it’s a good idea to let Chinese visitors know what to expect, take steps to help them acclimatize – and let them know that you’re doing this – and try to provide oxygen and/or other medical treatments in case of emergency, also making sure that these preparations are well publicized.

Then there are challenges of communication. On a linguistic level, tour operators should try to arrange Chinese-speaking guides or at least provide Chinese-language informational materials when possible. While it’s very unlikely that Chinese visitors will speak Spanish, English is a better option. Chinese travel agents we interviewed named lack of Chinese-language resources as one of the biggest issues with bringing groups to Peru, but requested English-language or photo menus for restaurants as an alternative and easier solution.

Beyond language, communications tools also differ between South America and China. In South America, Whatsapp is used very widely due to expensive local telephone rates, and can frequently be the platform through which hotels or tour operators contact their guests. However, Whatsapp is one of the many apps which is blocked in China, so it is highly unlikely that Chinese travelers will have it installed or even be able to find it on a Chinese app store. In this case, the ideal solution would be for South American tourism businesses to sign up for a free, individual WeChat account for basic communications, but email will also suffice.

The last challenge – the sheer distance between China and South America – is not one that can be resolved. Direct flights, whenever they are introduced, may help, but travel times will still be very long. But what this means is that South America is not at risk for the kind of “overtourism” and disruptively large Chinese tour groups that can become problematic in places like Hong Kong, Thailand, or some European cities. Rather, the “last continent” will instead be receiving the kind of wealthy, well-traveled Chinese, traveling individually or in small groups, that offer the most economic benefit to tourism destinations. With more education and publicity, the potential is fantastic.

Click here to watch the “Destination South America” episode of China Outbound Travel Pulse.

Many thanks to COTRI (China Outbound Tourism Research Institute) for their contribution to the data in this article.

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.