The Year of the Horse starts on 17 February, with an extra-long, nine-day public holiday starting on 15 February. What should overseas travel brands expect from the holiday? We’ve rounded up all the data released by Chinese travel agencies and booking platforms so far.

Dragon Trail International: Dragon Trail’s fifth Chinese Travel Trade Survey Report, released on 28 January, includes extensive travel agent survey data about Chinese New Year plans. Based on our survey results, we forecast that the majority of trips will be within Asia, with an especially strong outlook for South Korea, Thailand, and Singapore, alongside newly visa-free Russia. Family travelers will drive the market, as well as small groups. Read more from our report, or watch a recording of our webinar for more information.

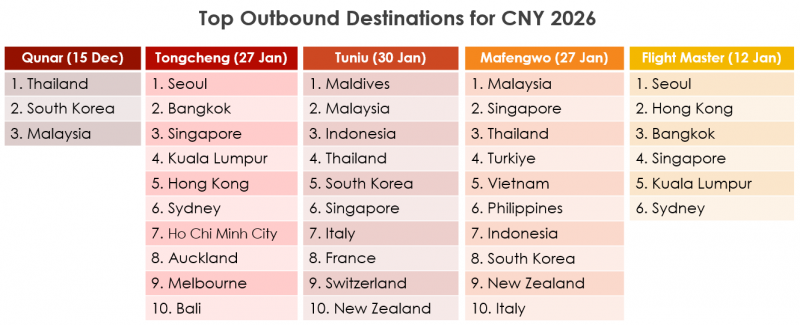

Qunar: On 16 December, OTA Qunar reported that outbound flight and hotel bookings for the holiday were already taking off, with Thailand, South Korea, and Malaysia the most popular destinations. The fastest growing long-haul destinations were Norway and New Zealand, with bookings up by 1.5 times and two times compared to last year, respectively. According to Qunar, the prices of flights – which start increasing on 9 February before peaking on 14 February – indicate that many travelers will be taking long trips and leaving well before the public holiday begins.

Airbnb: Released at the start of December, Airbnb’s report on Chinese New Year 2026 is based on user searches and offered a very early snapshot of trends in China’s FIT outbound travel market. The report says that searches for Spring Festival travel were already double that of the same period the year before, continuing the strong momentum from October’s Golden Week. More travelers were flexibly combining holidays to avoid peak travel periods – in February 2026, more than 70% of bookings were scheduled outside of the 9-day public holiday dates. The top 10 most-searched destinations were New Zealand, Norway, Thailand, Italy, Australia, Spain, France, South Korea, Malaysia, and the UK, with especially strong growth for New Zealand and Norway. A major trend identified by Airbnb based on searches is “getting close to nature and enjoying outdoor fun”.

Flight Master: As of mid-January, flight analytics company Flight Master said that outbound flight bookings were up by 63% compared to 2025. The top destination cities were Seoul, Hong Kong, Bangkok, Singapore, Kuala Lumpur, and Sydney.

Utour: By mid-January, long-haul outbound bookings for the Chinese New Year period were up by 60% year on year, according to leading travel agency Utour, while short-haul outbound bookings were up by 160%. Small groups of 20 people or fewer accounted for half of bookings. Utour’s Chinese New Year report noted that groups of around six people traveling to Southeast Asian destinations was the most popular kind of travel product.

Ctrip: Ctrip’s 15 January report highlighted the popularity of the Chinese New Year holiday for family travel – for domestic travel, more than half of bookings were for family travel. For families traveling with young children aged 0-12, the most popular destinations included Singapore, Bangkok, Kuala Lumpur, Sanya, and Kunming. For families with middle-school aged children, the top destinations were Sydney, Auckland, Seoul, Hong Kong, and Shanghai.

Mafengwo: Travel website Mafengwo caters to independent travelers. In their 27 January report, they noted a growth in outbound travel this Chinese New Year, with Malaysia, Singapore, Thailand, Turkiye, Vietnam, the Philippines, Indonesia, South Korea, New Zealand, and Italy on the top 10 list. Italy’s popularity is influenced by its role as host of the Winter Olympics says the report, while Turkiye and the Philippines’ presence on the top 10 list emphasizes the impact of visa-free policies. Interest in the Philippines had surged 196% in the preceding week, said the report.

Tongcheng: Visa-free Southeast Asian destinations are trending for Chinese New Year, according to Tongcheng’s 27 January report. The top 10 outbound destinations were: Seoul, Bangkok, Singapore, Kuala Lumpur, Hong Kong, Sydney, Ho Chi Minh City, Auckland, Melbourne, and Bali. The extra-long holiday period has fueled a surge in long-haul outbound trips, says Tongcheng. Flight and hotel bookings for newly visa-free Russia and Turkiye were up by 113% and 248% compared to last Chinese New Year, respectively. The report also notes rapid growth for travel to the Middle East, particularly the UAE, Saudi Arabia, and Oman. Classic European destinations are the top choice for travelers taking extended trips by combining annual leave with the public holiday for a 15-day break. The most popular European destinations included France, Italy, Spain, and the UK. Tongcheng also noted particularly high demand for outbound travel from non-1st-tier cities, with Chengdu, Chongqing, Wuhan, Urumqi, Taiyuan, and Changsha accounting for around 40% of bookings. Hangzhou surpassed Guangzhou this year to become the 4th largest source of outbound travelers, behind Shanghai, Beijing, and Shenzhen.

Tuniu: On 30 January, Tuniu released their 2026 Spring Festival Consumption Trends Report, in partnership with the China Association of Travel Services and based on Tuniu’s booking data. As a platform for outbound travel bookings, Tuniu specializes in group tours. 51% of travel packages on Tuniu for short-haul outbound trips during the Chinese New Year holiday were for independent travel, with 49% for group tours. For long-haul outbound trips, 97% of packages were for group tours, with just 3% of packages for FIT. The report emphasized the rising demand for small groups, customized tours, in-depth travel, themed travel products, and private group products including drivers and expert guides. Tuniu’s top 10 outbound destinations for the holiday were: The Maldives, Malaysia, Indonesia, Thailand, South Korea, Singapore, Italy, France, Switzerland, and New Zealand. Tuniu’s top 10 destinations with the fastest growth rates were: Uzbekistan, Kazakhstan, the Netherlands, Greece, Uruguay, Belgium, Georgia, Kenya, Austria, and Peru.

With an extra day added to the CNY holiday in 2025 and another extension in 2026, Tuniu users are taking longer-than-ever trips. Short-haul outbound trips averaged 5.7 days, almost the same as long-distance domestic trips (5.6 days). Long-haul outbound trips averaged 9.8 days.

The top 10 outbound destinations for FIT packages underscore Thailand’s popularity as a CNY destination: The Maldives, Bali, Bangkok, Phuket, Kuala Lumpur, Koh Samui, Chiangmai, Singapore, Kota Kinabalu, and Dubai. As of the end of January, the top 10 outbound tour products for Chinese New Year on Tuniu were: New Zealand (12 days); Spain-Portugal (13 days); Semi-guided trip to Saipan (6 days); Egypt (11 days); Singapore-Malaysia (5 days); Turkiye (10 days); Private family trip to Singapore (5 days); Malaysia-Sabah (6 days); Sri Lanka (8 days); Germany-France-Switzerland-Italy (12 days).

The top 10 outbound destinations for FIT packages underscore Thailand’s popularity as a CNY destination: The Maldives, Bali, Bangkok, Phuket, Kuala Lumpur, Koh Samui, Chiangmai, Singapore, Kota Kinabalu, and Dubai. As of the end of January, the top 10 outbound tour products for Chinese New Year on Tuniu were: New Zealand (12 days); Spain-Portugal (13 days); Semi-guided trip to Saipan (6 days); Egypt (11 days); Singapore-Malaysia (5 days); Turkiye (10 days); Private family trip to Singapore (5 days); Malaysia-Sabah (6 days); Sri Lanka (8 days); Germany-France-Switzerland-Italy (12 days).

Dragon Trail International wishes all our readers a very happy Chinese New Year. We’ll provide updates after the holiday on the results from all of China’s major travel agencies and government bodies relating outbound travel. Subscribe to our newsletter and follow us on LinkedIn to make sure you don’t miss out on future Chinese outbound travel news and Dragon Trail reports.

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.