VFS Global to provide Germany visa services in 14 Asia Pacific countries

How worried should US destinations be about attracting Chinese tourists? In May, the US National Travel and Tourism Office reported a 5.7% drop in Chinese arrivals in 2018, the first decline in 15 years. Bank of America Merrill Lynch estimates that in a worst-case scenario, Chinese tourism could fall by 50%, causing a loss of $18 billion. Official Chinese warnings about travel to the US, and sentiment analysis online in China also point to pessimistic prospects.

But are political tensions related to the Sino-US trade war to blame for the drop in tourism? A closer look reveals that there are actually many other factors at play. There is also strong evidence of continued interest by Chinese citizens in traveling to the US, and US destinations that not only avoided 2018’s decline, but saw significant growth during the same period.

To provide some clarity as to the current situation, future prospects, and what US destinations should do, we have compiled a report based on a variety of trusted travel news sources, as well as our own data, to look at the situation objectively and from multiple angles, and provide Dragon Trail Interactive’s professional opinion and advice.

Why the US tourism industry should be worried

There are good reasons for US destinations and tourism businesses to be anxious about the future prospects of Chinese tourism. A “tourism ban” like the one placed on South Korea in 2017 cannot be replicated for the US – in the case of South Korea, group tourism and cruises were not allowed to operate from China. Cruise travel from China all the way to the US is not a significant source of tourism by any means, and 78% of Chinese tourism to the US in Q2 2018 was independent, not group travel.

However, there are many other tactics that the Chinese government could choose to employ to dissuade travelers from visiting the US. Negatively influencing public opinion through the media – which is all state-controlled to at least some extent – is the obvious choice. In the summer of 2018, several official travel warnings for the US were issued to Chinese citizens. The Embassy of the People’s Republic of China in the US released one travel advisory on June 28, 2018, warning about violence, robbery, and the high cost of medical care in the US. The Consulate of the People’s Republic of China in Los Angeles issued another advisory on July 11, 2018, warning against dangerous activities and scams. Neither of these were mentioned at all on the Chinese Ministry of Culture and Tourism’s WeChat account in the summer of 2018 – during that time, the Ministry’s account did publish a warning about robberies in France, with 1,006 views; an official summer safety warning about activities like parachuting and diving, with 11,400 views; and a travel advisory for southern Turkey, with 1,489 views. No Chinese travelers whom Dragon Trail interviewed in China or the US had heard about the US safety warning by August 2018.

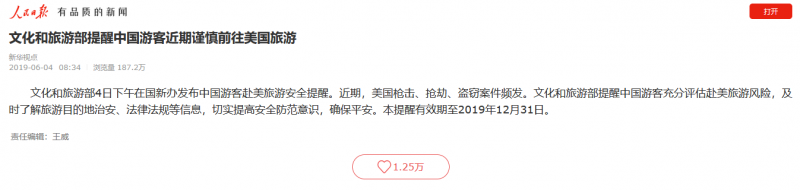

In contrast, on June 4th, 2019, the Ministry of Culture and Tourism issued a new safety warning for travel to the US. This one was published on their WeChat account, and has received over 32,000 views to date. The advisory has also been heavily covered in the Chinese media. When published by the People’s Daily, it got close to 19 million views, and over 1 million likes. Additionally, anti-US editorials are being published regularly in Chinese state media, even rallying nationalistic sentiment about events that happened during the Korean War, nearly 70 years ago.

People’s Daily article on the June 4, 2019 travel warning, with nearly 19 million views

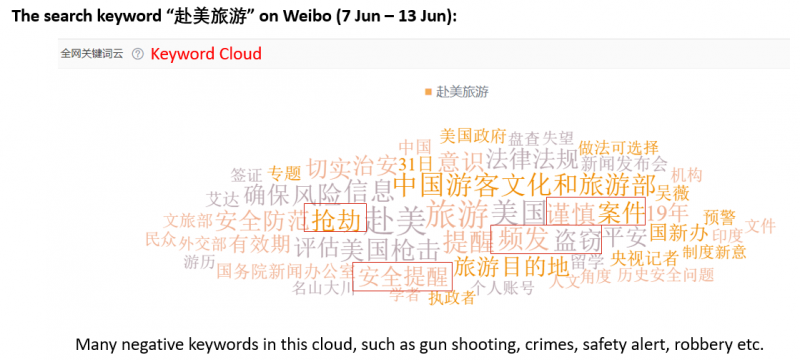

On Sina Weibo, the search term ‘travel to the US’ was rising hourly during the period between June 7-13, and the keyword word cloud associated with the search was largely negative, with “shooting”, “crime”, and “safety alert” some of the most frequent terms. While independent Chinese travelers might ignore government-to-government relations in their travels, safety is one of the most – if not the most – important aspect that Chinese travelers consider when choosing a travel destination, so widespread fear of the US being unsafe is likely to dissuade tourism.

On leading Chinese search engine Baidu, searches for “travel to the US” were down 14% from May 14-June 2, compared to the same period the year before. However, news results for the same topic were up by 45,329%, which shows that Chinese web users are being inundated with news stories on travel to the US, and they are probably not very positive ones. Baidu searches for “US-China trade war” were up over 300% year on year, with news results up by 657%.

But is this a Chinese tourism problem, or a global one?

Of course, the new travel warning and incredible increase in attention it’s getting in China compared to last summer’s warning, can be understood in the context of deteriorating Sino-US relations. But we cannot definitively link this specific political situation to the drop in Chinese tourism to the US. The US tourism industry in general is in a precarious situation, according to reports from June’s IPW conference by the Inbound Report and Skift. Tourism to the US overall is growing more slowly than tourism to Europe, Asia Pacific, and the Middle East. And Middle Eastern, Mexican, Canadian, South Korean, Japanese, and German tourist arrivals to the US have also all declined since 2016. Reasons for this include political image and policies by President Trump, and a strong dollar, according to Skift.

What role is the US playing in the decrease?

Putting aside the trade war and hawkish stances towards China from both legislative and executive branches of the US government, there are other, very measurable ways in which the US itself may be actively contributing to the slowdown and decrease of Chinese tourism.

Perhaps most important is the increase in visa rejection rates, which have been growing since 2014 and reached 17% last year, compared to a low of 8.5% in 2012 and 2013, according to US State Department data. With ever-growing numbers of Chinese passport holders and international travelers, will come increasing numbers of would-be tourists who may want to apply for a US visa, but rejections and bureaucratic difficulty will impede the US from taking advantage of this new wave of travelers. Long lines of visa applicants could still be seen outside the US embassy in Beijing in the days following the June travel warning, which is good news in that it shows sustained demand, but it also potentially points to an inefficient and inconvenient visa application process.

Long lines of visa applicants outside the US embassy in Beijing, in the week following June’s travel warning

Countries like Germany are opening new visa application centers across China, and others from all over the world – from Serbia, to Morocco, to the UAE, to Peru – are all either seriously reducing visa requirements or even going entirely visa-free for Chinese citizens. As the US gets stricter – now demanding social media information from nearly all visa applicants – Chinese may decide to go to countries that seem more welcoming and are easier to visit instead.

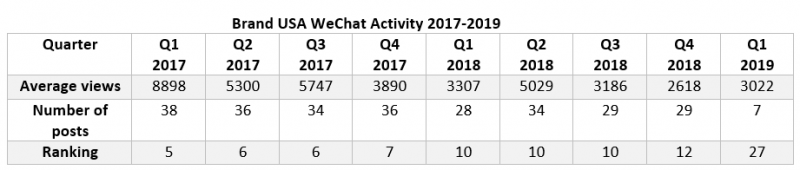

In the midst of all of this, Brand USA has gone very quiet on WeChat. The account posted just seven times in Q1 2019, compared to 28 times in Q1 2018, and 38 times in Q1 2017. Since Q2 2019 began, Brand USA has made it to the top 20 national tourism boards on WeChat just one week, in mid-April. Article volume had already been declining slightly from 2017 (144 posts throughout the year) to 2018 (120 posts), and the US has slipped down the rankings from no. 5 in Q1 2017 to no. 12 in Q4 2018, and no. 27 in Q1 2019. Brand USA continues to post once or twice a day from its Weibo account, however.

Reasons for optimism in some markets

There is no evidence to support the idea that Chinese people’s desire to travel to the US has declined, but there is evidence of the opposite. First, there are the undiminished lines of prospective travelers lined up outside the US embassy. Second, US destinations continue to receive high levels of attention on WeChat.

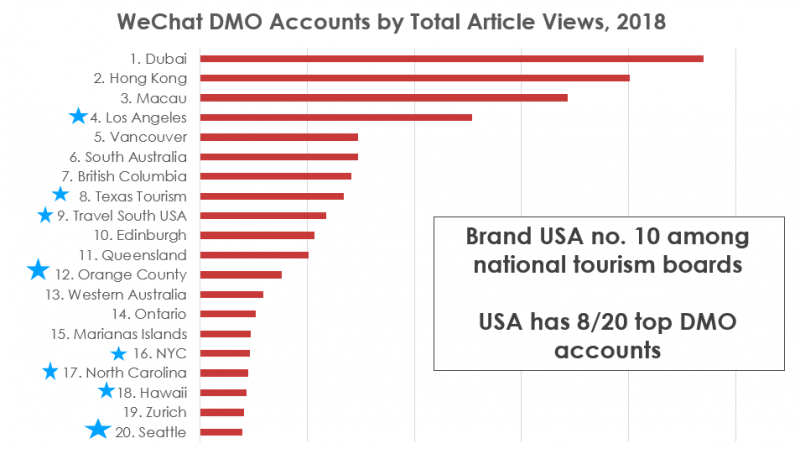

Brand USA might be falling off the radar on China’s leading social media platform, but the same cannot be said for US destination marketing organizations. In Q1 2017, US destination accounts made up three of the top 20 DMO accounts on WeChat. By the end of the year, there were six US DMOs on the rankings table for the full year. This then grew to eight out of the top 20 DMOs in the world for 2018. In Q1 2019, seven US DMOs made the top-20 list, with four in the top 10.

One of the top-ranking US DMOs is Los Angeles, which came in 4th place for DMOs on WeChat in both 2017 and 2018. Los Angeles also stands out for not only avoiding the decrease in Chinese tourism in 2018, but by growing Chinese arrival numbers by an impressive 6.9% during the year. New York City was another destination to buck the trend, with a 5.4% increase. As this article from Bloomberg explains, these two cities have been extremely proactive in attracting and catering to Chinese tourists, with both digital marketing and tourism training initiatives.

One of the most important things to understand about the Chinese outbound tourism market is how segmented it is, and this also has significance in understanding Chinese travel to the US. ForwardKeys’ data from January-August 2018 showed a huge discrepancy between the FIT market, down only 3.9%, compared to group travel, which was down by 34.4%. And within the FIT market, business travel and visiting friends and relatives (VFR) were less affected than leisure travel. According to COTRI Analytics, around 20% of Chinese travel to the US and Canada is VFR, and this significant demographic should remain stable. Delta’s CEO also recently stated that Chinese business travel to the US is still stable. VFR and business travelers are both likely to include tourist activities and shopping on their travels.

Does the decline in Chinese tourism extend beyond the US?

The US is not the only destination to suffer from declining Chinese tourism. New Zealand has also seen a big drop in 2019, with numbers in April even lower than in 2017. While Chinese tourist numbers and spending both continued to grow in 2018, Australia is reportedly experiencing a slowdown as well. COTRI data from Q4 2018 showed that Chinese travelers were staying closer to home, and that trips to Greater China had increased as a percentage of Chinese outbound travel.

While New Zealand and Australia are not in any conflict with China, it’s possible that they and other long-haul destinations are affected by the trade war’s impacts on the Chinese economy and consumer buying power. Chinese tourism to the Marianas Islands was also down by 14% in May, a decrease which is blamed on the USD-RMB exchange rate, and thus an indirect casualty of the trade war. Chinese tourism to Europe, on the other hand, is seeing healthy growth, and Chinese trade with the Euro zone is up. Conversely, Chinese exports to Australia are flat, and imports and exports are both down with the US and New Zealand. This implies that larger economic factors are actually having more of an effect on travel destinations than politics, safety fears, or other factors.

Is the market declining, or just changing?

We’ve read several US news articles that cite poor sales figures at Tiffany as one immediate casualty of the trade war and its effect on tourism. But shopping has for some time been declining as an important element of Chinese travel, especially luxury shopping, and this was true for Europe in 2018 as well. Big-name luxury brands like Tiffany may be affected by changing Chinese shopping habits and brand preferences, as well as exchange rates and the greater affordability of luxury goods domestically.

The New York Times ran a story on June 12 that stated “in San Francisco, busloads of Chinese tourists were once a mainstay of one fine jewelry business; over the last few years, the buses stopped coming.” What the article fails to mention is that also in the last few years, the US Department of Transportation cracked down on hours of service regulations for drivers, which put a dent in the business of many Chinese bus tour operators on the West Coast. Greater attention to the hours driven, and fines levied, significantly raised the price of the tours, diminishing the “three states per day” budget tours and shopping itineraries. San Francisco is specifically one of the cities most affected by this enforcement, as drivers now choose to avoid big cities in an effort to cut down on driving time and accommodation costs. US legislation aside, Chinese package bus tours are decreasing all around the world. Businesses that want to hang on to the Chinese market need to become more proactive in B2C marketing for independent Chinese travelers, or in building stronger relationships with the Chinese travel trade to ensure that they’re still on the radars of the remaining group tours.

Takeaways and suggestions for marketing

– Actions by both the US and Chinese governments have major potential to disrupt Chinese tourism to the US. While much of this is out of the hands of the tourism industry, the potential to lobby the US government on issues such as visa policy, and the importance of tourism to the economy, should be considered if possible.

– Changes to the Chinese tourism market also play a role, and destinations and businesses need to keep up to date with these, understand where the market potential is, and how to best reach these travelers. At the same time as reaching out to the growing and important FIT segment, US travel brands can also work to counteract the sharply decreasing group travel market through renewed initiatives focusing on the Chinese travel industry.

– As visa policies become stricter, and more inexperienced travelers have demand for visas, we recommend providing training to the Chinese travel industry to teach them how to guide travelers through the process and avoid rejections.

– Fears about safety, especially gun violence, create a serious image problem for the US. These can be addressed through B2C marketing efforts (see Jing Travel’s article for suggestions and examples) and through training Chinese travel agents, who will be on the frontlines when it comes to answering questions and allaying fears.

– An unwelcoming image is another major obstacle for US tourism brands. This can also be addressed through marketing efforts – Los Angeles’ global ‘Everyone is Welcome’ campaign from 2017 is an excellent example.

Sources:

Airlines and casinos stand to take a hit from China’s warning against traveling to the US

Chinese Tourists Won’t Be Weapons Much Longer

Ministry of Culture and Tourism Warns Chinese Tourists about Traveling to the US (in Chinese)

College Row, Fifth Avenue Should Brace for Fewer Chinese Visitors

China ratchets up anti-US rhetoric with old war films and travel alerts

Selling US Tourism in Trump Era Leaves Industry Grasping for Fixes

State Dep’t Statistics on B Visa Refusals for Chinese Nationals

Trade War Hurts Tourism: Chinese flight bookings to US ‘down 42 per cent for National Day holidays’

US Now Requiring Visa Applicants to Provide Social Media Details

Delta CEO: Despite the Impact of the Trade War, Revenue from China Is Still Rising (in Chinese)

Chinese visitor numbers dip in China-NZ Year of Tourism 2019

Chinese Tourists’ U.S. Spending Has Plunged. The Trade War May Be to Blame.

How Safety Concerns Can Take a Toll on Chinese Tourist Numbers

IPW Delegates Saw it This Way: “Flat,” “Pretty Good,” or Somewhere in between

China Issues US Travel Warning Amid Trade Tensions

Trade war with China hits US tourism, says ForwardKeys

International Travel Slowdown Hits US

Hollywood Allure Outshines Trade War for Chinese Tourists

The Chinese tourism boom hits the wall

Trade War vs. Chinese Tourism: How Should US Marketers Respond

The First Decrease in Chinese Tourism in 15 Years, America Reflects (in Chinese)

Video: Destination North America – China Outbound Travel Pulse Episode n.20

Chinese international outbound tourism shrinks in Q4 2018

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.