Dragon Trail’s WeChat Rankings Report for Q1 2025 examines and analyzes the performance of eight categories of travel brands on WeChat: national tourism organizations (NTOs), destination marketing organizations (DMOs, referring to regional and municipal tourism boards), airlines, cruise lines, museums and attractions, hotels, airports, and car rental companies.

Top-performing accounts and content on social media platform WeChat in Q1 2025 underscore the strength of Asian destinations for Chinese outbound tourists. But we also see significant engagement with content promoting the Middle East, Australia, Scandinavia, and other parts of Europe.

Across nearly all categories, Chinese New Year-themed content attracted the most attention on WeChat in the first quarter of the year, including digital red envelopes, phone wallpapers, WeChat stickers, sales, giveaways, activities, and holiday greetings. As the most important Chinese holiday of the year, Chinese New Year remains a highly relevant period for marketing and sales promotions, as well as a peak time for outbound travel.

NTOs

Japan was the country of choice for China’s outbound tourists in Q1 2025, and it outperformed the competition on WeChat as well, with nearly twice as many content views as the Tourism Authority of Thailand’s Beijing office account, in second place. Japan’s content is inspiring and written in a practical way to attract reader attention – for example, one of the most-read articles was about Kagoshima, a city promoted as being just 1.5 hours from Shanghai by air. Another article recommended the small city of Tamba Sasayama, promoted as just 1 hour from Osaka. These recommendations help travelers to easily build their itineraries and make the most of their time traveling.

(Left to right) Japan National Tourism Organization’s useful guide to South Kyushu; The Scandinavian Tourism Board announces the return of Beijing-Oslo flights; The Tourism Authority of Thailand uses Lisa’s role in The White Lotus to promote luxury hotels

Three Tourism Authority of Thailand (TAT) accounts ranked 2nd, 3rd, and 4th for total article views – the tourism board is clearly hard at work to win back Chinese travelers, who have been slower to return to Thailand compared to other popular Asian destinations. Top articles included a giveaway, a guide to Koh Lipe, a promotional event in the Chinese city of Harbin, and two articles about pop star Lisa and her role in season 3 of The White Lotus – set in Thailand.

Other popular content from NTOs in Q1 included the Scandinavian Tourism Board’s announcement about the resumption of direct flights between Beijing and Oslo; Turespaña’s extensive article on “Reasons to Visit Spain in 2025”, highlighting an extensive list of awards and accolades for various regions of Spain in 2025, alongside events in culture and sport, exhibitions, and anniversaries; and a post about celebrating Chinese New Year in Malaysia.

DMOs

Macao continues to lead the DMO category for total content views, though neighboring Hong Kong is close behind when we look at average views per post. The most-read article of the quarter was about Macau’s new entry policies for mainland Chinese citizens living in Zhuhai and Guangdong. Both Hong Kong and Macao attracted many views on WeChat for their Chinese New Year red envelope posts.

(Left to right) Chinese New Year red envelopes from Hong Kong; UGC from Abu Dhabi; Hidden gems in Dubai

In 3rd and 4th place is another pair of neighboring cities: Dubai and Abu Dhabi. Dubai’s reading rates are very consistent – without some of the extreme spikes we notice from some accounts, which tend to indicate paid boosts. Similar to Hong Kong and Macau, Dubai’s most popular post of the quarter was a digital red envelope promotion. Other content includes recommendations for activities and events, hidden gem destinations, tips for taking great photos, and information about the Muslim holy month of Ramadan. Abu Dhabi also published content about Ramadan, alongside articles on food, solo travel, and UGC from travelers who visited during Chinese New Year – as well as a Chinese New Year giveaway post with a chance to win free round trip plane tickets on Etihad.

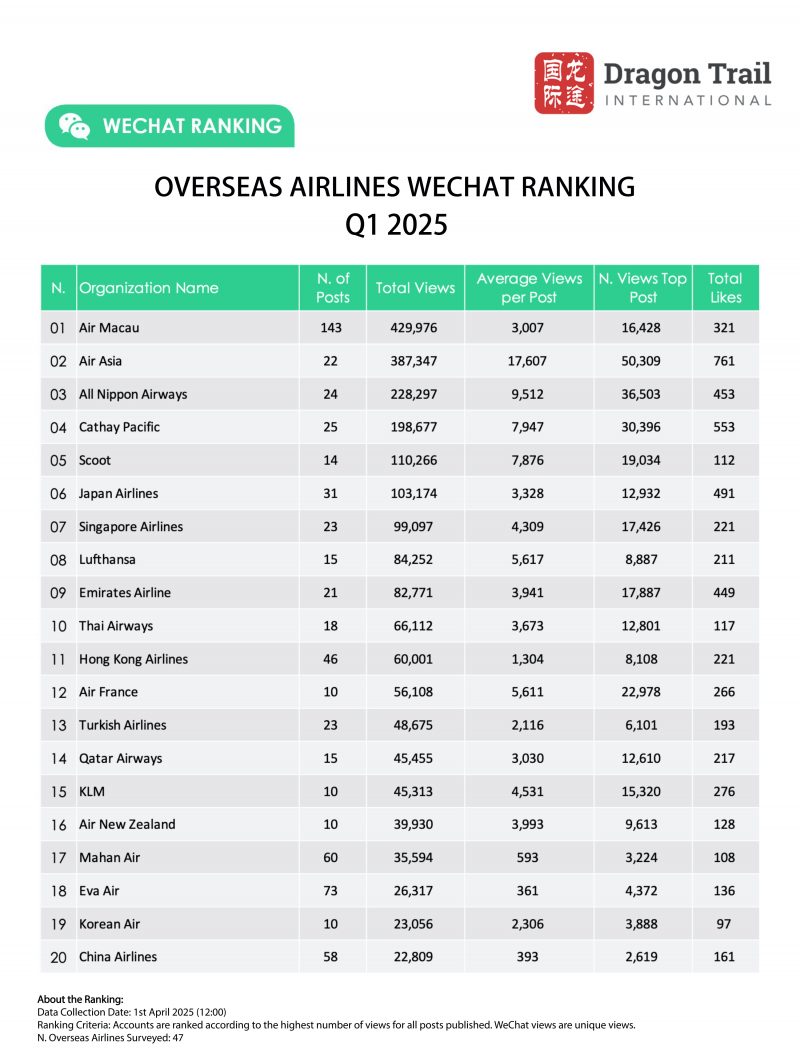

Airlines

AirAsia once again led the airline category, promoting affordable flights to popular destinations around Southeast Asia. Its most popular content included RMB0 fare promotions, family travel in Sabah, and trendy cafés in Thailand.

Wing Chun dance performers for Cathay Pacific, and AirAsia’s guide to trendy cafes in Thailand

With more than 30k views, Cathay Pacific’s most popular article came out just after the Chinese New Year holiday, and promoted how the airline is putting Chinese culture on the world stage by partnering with the Shenzhen dance performance called Wing Chun. The performance has previously partnered with Chinese EV maker BYD.

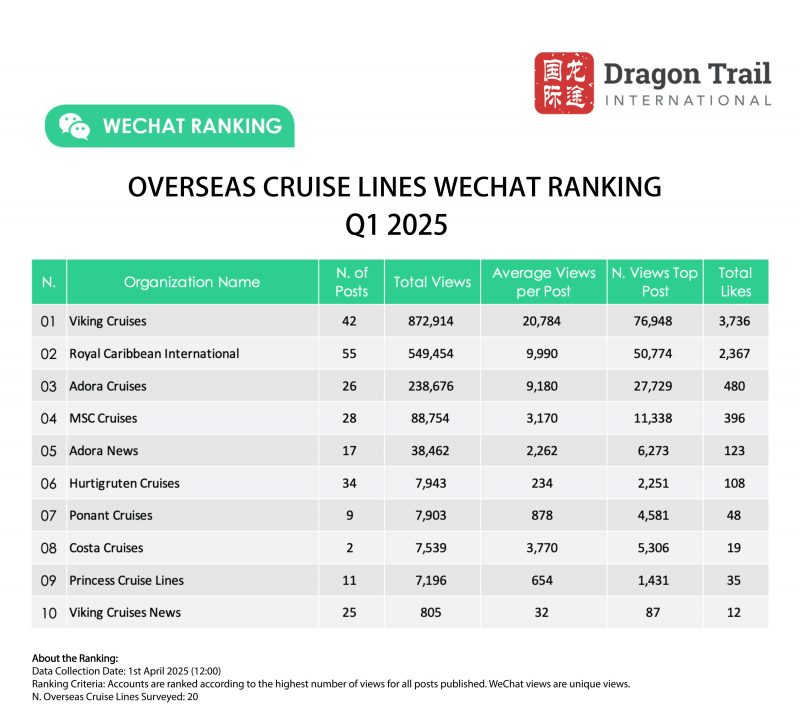

Cruise Lines

Viking Cruises was strongly in the lead this quarter for total views as well as average views per post, and the top eight most-read articles in the category were all published by Viking, promoting river cruises in Europe with promotional prices and packages, information on excursions and on-board dining, and a giveaway. The most-read posts by Royal Caribbean International, in 2nd place, were for a buy-two-get-two offer aimed at families.

Attractions and Museums

Hong Kong Disneyland accounted for 83.5% of the total article views in the attractions category in Q1. The theme park’s top articles featured phone wallpapers and WeChat stickers for Chinese New Year, the characters Duffy and Friends, seasonal features, and new merchandise.

The most-read WeChat content by a museum was a post from the British Museum about an emergency closure due to an IT outage. Other museum posts with high readership included the British Museum’s international touring exhibitions, Chinese New Year wallpapers from the V&A’s collection of 19th century China export watercolors, and a snake-themed post from the Louvre for the Year of the Snake.

Hotels

Chinese New Year-themed content also brought the most views for international hotels, especially red envelopes from Hilton (67,429 views) and InterContinental (49,972 views). Promotions and benefits for loyalty program members attracted many WeChat users to posts from InterContinental and Marriott as well.

Chinese New Year posts from Hilton (left) and InterContinental (right), plus new openings around the world from Melia (center)

Ranked 3rd for total views and 1st for average views per post, Melia Hotels received more than 45k views for a post about 18 new properties opening around the world in 2025, from Vietnam to Albania to Cuba. Melia’s second-most read article promoted Valentine’s getaways at a number of domestic Chinese properties.

Airports

The top Q1 2025 WeChat posts by Hong Kong International Airport, Singapore’s Changi Airport, and Osaka’s Kansai Airport were all related to Chinese New Year. Hong Kong’s was an animated and musical greeting with snakes, Spring Festival couplets, red envelopes, and WeChat stickers. Changi offered phone wallpapers, giveaways, and discounts in airport venues. Finally, Kansai Airport attracted views by giving away prizes featuring SORAYAN, its cute airplane mascot.

Chinese New Year posts from (left to right) Singapore Changi Airport, Osaka’s Kansai Airport, and Hong Kong International Airport

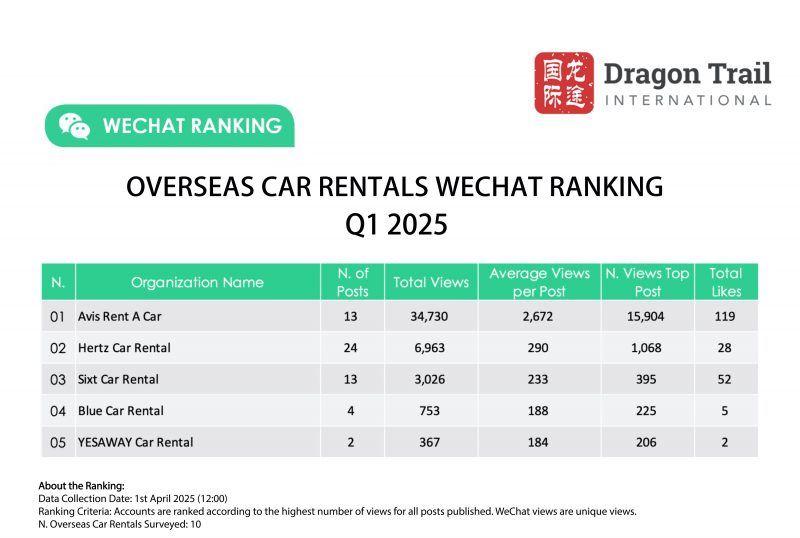

Car Rentals

In the car rentals category, Avis was far ahead of other accounts in Q1, accounting for 75.7% of all views. Avis’ top articles were a Chinese New Year promotion, an article about family travel in Australia, and other promotions for Australia and the US. With 1,068 views, the most-read article by 2nd place Hertz was a self-driving guide to Guam.

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.