Dragon Trail International’s Xiaohongshu Rankings Report tracks and analyzes performance for national tourism organizations (NTOs), destination marketing organizations (DMOs), airlines, cruise lines, museums & attractions, and hotels. The quarterly Xiaohongshu report builds industry benchmarks and uncovers best practices in digital marketing in the travel sector.

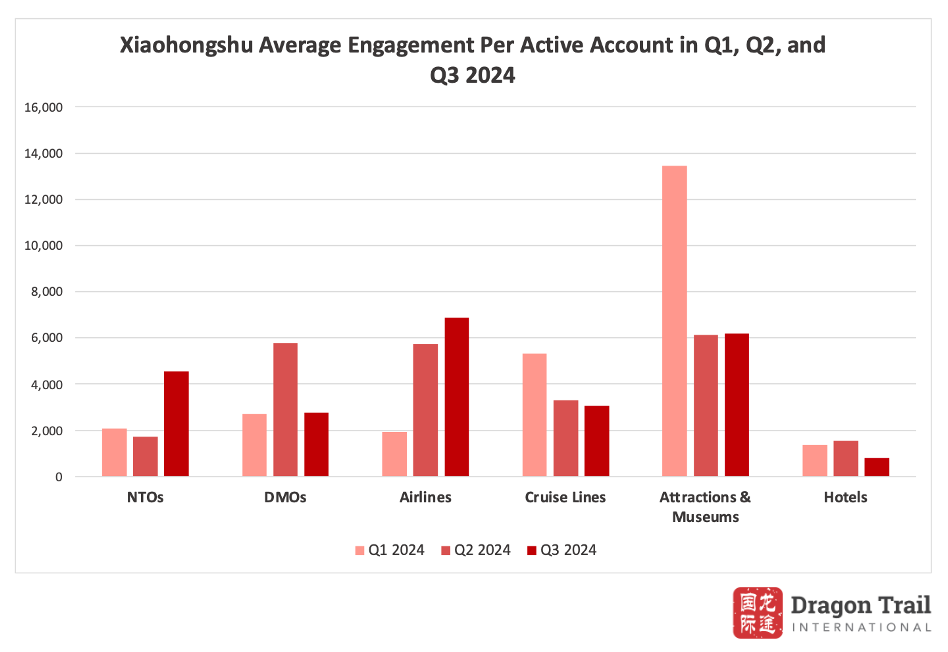

Engagement Trends Comparison Between Q1, Q2, and Q3 2024

In Q3 2024, there was a remarkable surge in NTO engagement, which increased by 163% compared to Q2, bouncing back after a dip. Airlines also saw growth, rising by 19.9%, signaling strong interest in travel by air. Conversely, DMOs experienced a 52% decline, while hotel engagement dropped by 48.7%, possibly reflecting reduced travel demand or a shift in consumer focus. Cruise lines saw a modest decline of 7%, and attractions remained relatively stable, with only a slight 1.5% increase.

NTOs

Tourism Australia and the Swiss National Tourist Office retained the top two positions in the NTOs category in Q3 2024, generating a combined total of 47,565 engagements. Notably, Tourism Australia saw an impressive 465% increase in engagement compared to the previous quarter, contributing to over half of the category’s total engagements. Thailand’s three accounts also rose in the rankings, securing 3rd, 4th, and 6th places. All other NTOs that ranked in the top 10 in Q2 remained in the top 10 for this quarter.

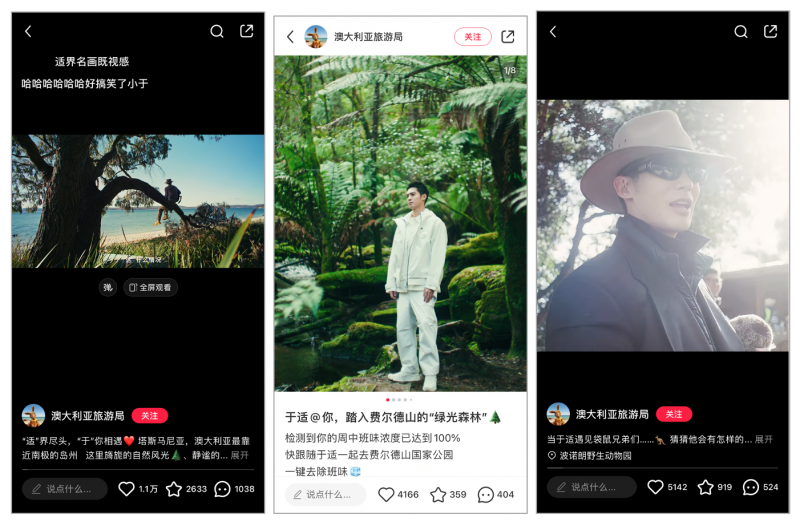

Six of the most popular posts originated from Tourism Australia, with five of these featuring actor Shi Yu, garnering 33,780 total engagements. The posts highlighted destinations such as Tasmania, Bonorong Wildlife Sanctuary, Mount Field National Park, and Richmond, and the hashtag #TravelAustraliawithYuShi received 233,000 views on Xiaohongshu. Other popular content included posts about the Alpabzug Festival celebrating livestock returning from Alpine pastures, Northern Thailand’s Khao Soi participating in Xiaohongshu’s “Hidden Flavors” campaign (see more details in the DMO section below), Switzerland’s National Day on August 1st, and the “Nihao Month” initiative celebrating the Mid-Autumn Festival and China-Thailand friendship on September 17, 2024.

Tourism Australia’s posts featuring Shi Yu

DMOs

Discover Hong Kong and the Macao Government Tourism Office continued to lead the DMO category, generating nearly half of the total engagements. However, Discover Hong Kong’s engagement dropped significantly from 78,857 to 21,528, a 72.70% decline, contributing to an overall decrease in the category’s total engagement, despite maintaining a similar posting frequency. Visit California and the South Australian Tourism Commission replaced Visit Sydney and the Dubai Department of Tourism & Commerce Marketing in Q3, securing 6th and 9th places, respectively.

The most popular post came from York, featuring a video showcasing autumn scenes such as cozy cafés, cobblestone streets, and charming bookstores filled with seasonal ambiance. Discover Hong Kong also saw strong engagement from posts about its Halloween celebration guide, the 27th anniversary of the HKSAR, and September exhibitions.

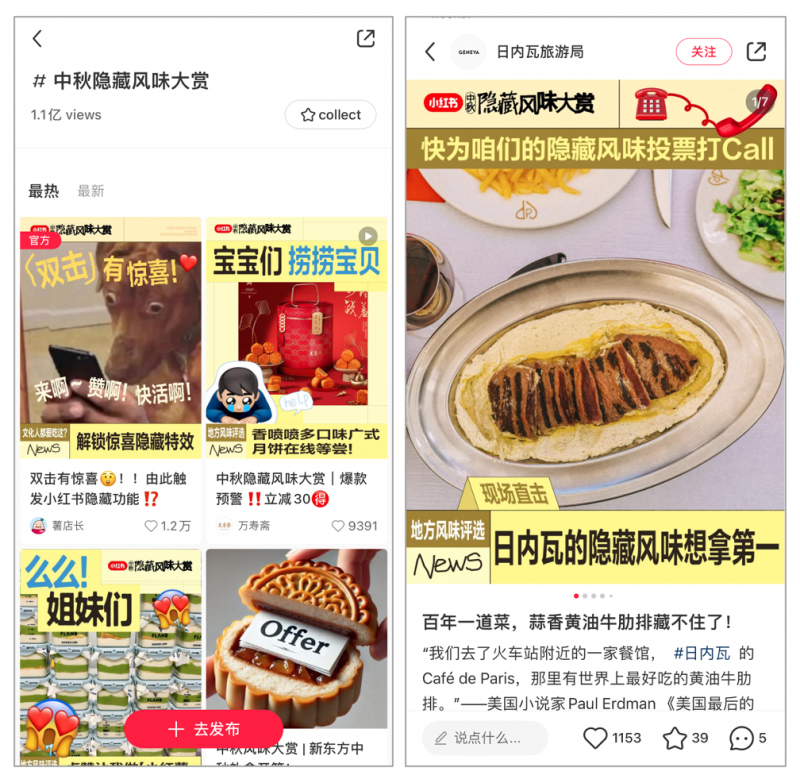

Notably, during the Mid-Autumn Festival, Xiaohongshu launched a hashtag campaign called the “Hidden Flavors Contest,” attracting over 110 million views. Many international and domestic NTOs and DMOs participated by sharing their traditional yet niche delicacies. As mentioned above, TAT highlighted Northern Thailand’s Khao Soi, while Geneva Tourism participated with a post about its traditional garlic butter steak, providing the dish’s origin and history, which garnered 1,570 engagements.

Xiaohongshu’s “Hidden Flavors Contest”

Airlines

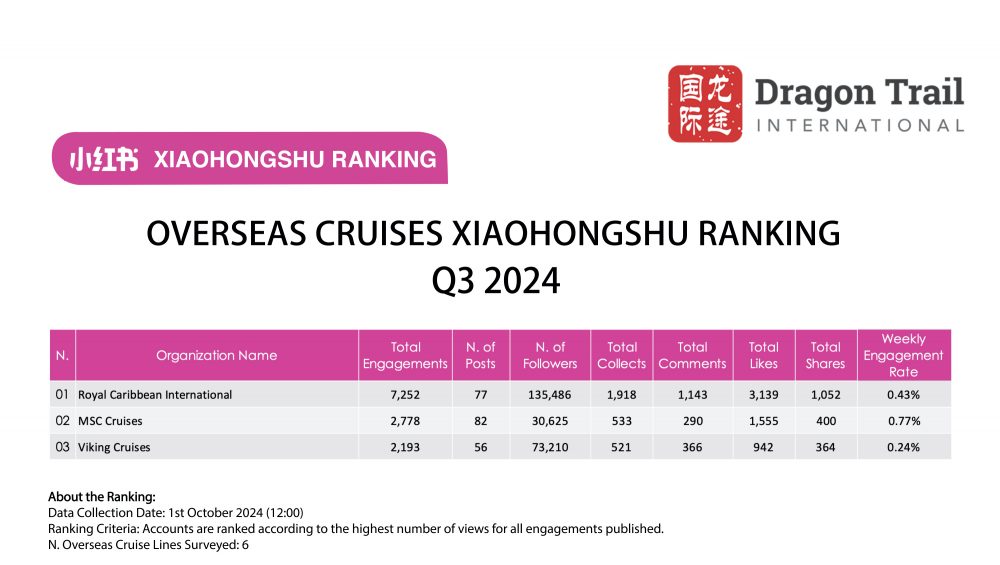

Cruise Lines

Attractions & Museums

Hong Kong Disneyland maintained its dominance in the Attractions category during Q3, achieving 47,583 engagements and contributing almost 70% of the category’s total. The British Museum dropped out of the top 5 and was replaced by LaPedrera. Remarkably, 9 of the 10 most popular posts came from from Hong Kong Disneyland, featuring highlights such as Halloween celebrations, merchandise for Duffy and Friends, CookieAnn’s “Friendversary” celebration, Chinese Valentine’s Day festivities, and limited-edition Mid-Autumn Festival merchandise.

Attractions accounts primarily focused on promoting upcoming holiday-related events and festivities, with key holidays in Q3 including Chinese Valentine’s Day, the Mid-Autumn Festival, and Halloween. Museum accounts, in contrast, centered their content on upcoming exhibitions, introductions to specific artists or artworks, and historical insights into their collections.

Hotels

Hotel-related content on Xiaohongshu receives significantly less engagement compared to Weibo. While many popular hotel posts on Xiaohongshu feature celebrities, they tend to garner fewer interactions due to the platform’s comparatively weaker celebrity and brand presence. In contrast, Weibo’s strong integration with news, live streaming, and multimedia content makes it easier for fans to access and share updates about their favorite celebrities.

Xiaohongshu’s primary focus on lifestyle content may limit its appeal for fans seeking diverse content or engaging with fan communities, which are more robustly established on Weibo.

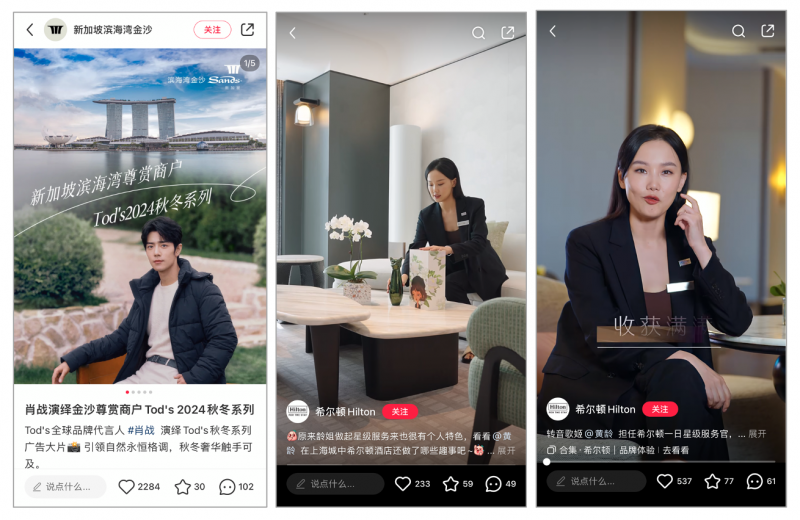

The four most popular posts in the hotel category during this period were all from Marina Bay Sands Singapore. These included content featuring Zhan Xiao as Tod’s global brand ambassador, the F1 Grand Prix Singapore stop, Singapore’s 59th anniversary, and JJ Lin’s concert collaboration with Miracle Coffee’s Tokyo stop.

Top celebrity-related content in the hotel category

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.