Dragon Trail’s WeChat Rankings Report for 2023 examines and analyzes the performance of six categories of travel brands on WeChat: national tourism organizations (NTOs), destination marketing organizations (DMOs, referring to regional and municipal tourism boards), airlines, cruise lines, museums and attractions, and hotels.

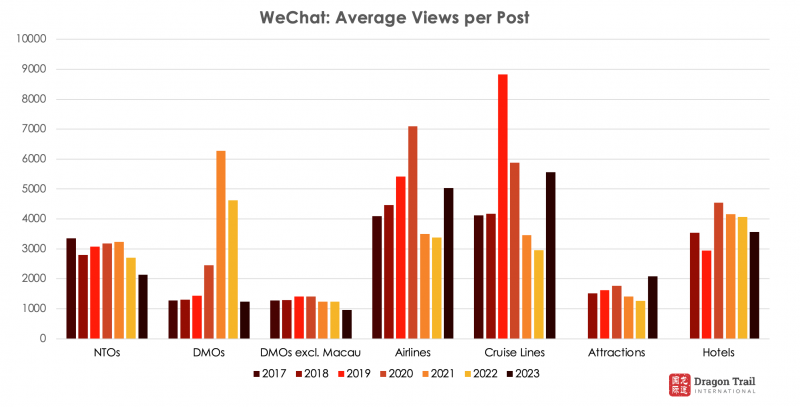

2023 showcased mixed performance in average readership across different categories on WeChat. 2023’s data will serve as a valuable benchmark to see how WeChat marketing content and the audience for this content develops and recovers now that Chinese outbound tourism has slowly recovered.

Reading Rates

Compared to 2022, reading rates decreased in four categories and increased in three. Cruise lines saw the highest increase at 88.28%, followed by attractions at 64.59%, and airlines at 48.42%. Conversely, DMOs showed the most significant decline at -73.28%. DMOs excluding Macau, DMOs, NTOs, and Hotels experienced relatively mild declines at -22.59%, -21.11%, and -12.60%, respectively.

NTOs

The Japan National Tourism Organization garnered the highest number of views (1,476,185) and likes (12,837) in 2023, constituting 16.17% of the total article views generated by 57 WeChat accounts in the NTO category.

Destinations that posted about visa exemption policies for Chinese nationals, such as Thailand, Malaysia, and Singapore, or other outbound travel policies (such as the resumption of outbound group tour services) often received high views. The Tourism Authority of Thailand – Chengdu Office’s article announcing the visa-free policy for Chinese tourists traveling to Thailand garnered the most views at 69,883.

WeChat posts from Thailand, Malaysia, and Japan

Notably, the Austrian National Tourist Office rose from 16th place in 2022 to 6th place in 2023. Its most-viewed post, with 30,252 views, introduced the Habsburgs walking tour, providing a journey through the entire history of the Habsburg dynasty. Other popular posts by the organization mostly included guides and introductions to destinations in Austria.

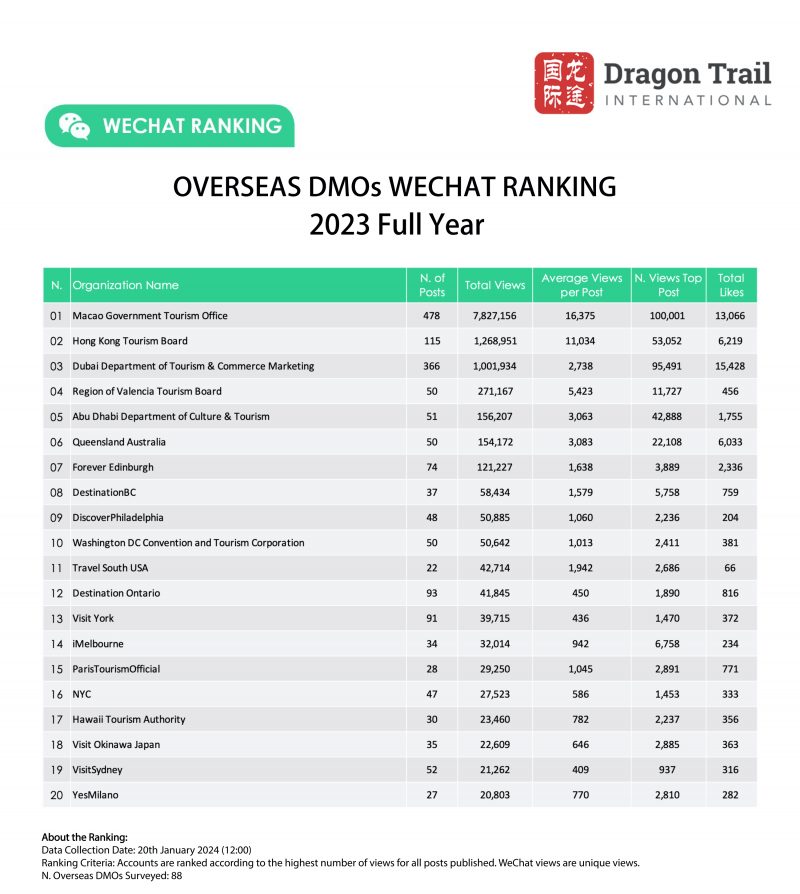

DMOs

Macau continued to dominate the DMO category, with 41 out of the 50 most-read posts in 2023 originating from Macau, accounting for 68% of all content views. However, this was a decrease from the previous years. Macau’s most-viewed articles typically focused on weather updates, upcoming events, and tourist guides.

The Abu Dhabi Department of Culture & Tourism rose to 5th place in the ranking for the first time since 2017. Its most-viewed article, posted in Q1 of 2023, highlighted restaurants offering Chinese festive cuisines to celebrate the Lunar New Year.

While the Hong Kong Tourism Board consistently received high views, this year’s total views nearly doubled compared to the previous year, showing a substantial 92% increase. The tourism board’s most-viewed article was posted on 10 January, 2023, after the Chinese government announced that it will reopen its border with Hong Kong on January 8, which is nearly three years after tight control. The article offers a specific tourist guide which includes a list of attractions, museums, concerts, and events recommendations. Other content posted by the tourism board mainly centered around food and tourist guides, and holiday-specific celebration guides.

WeChat posts by Macau, Dubai, and Hong Kong

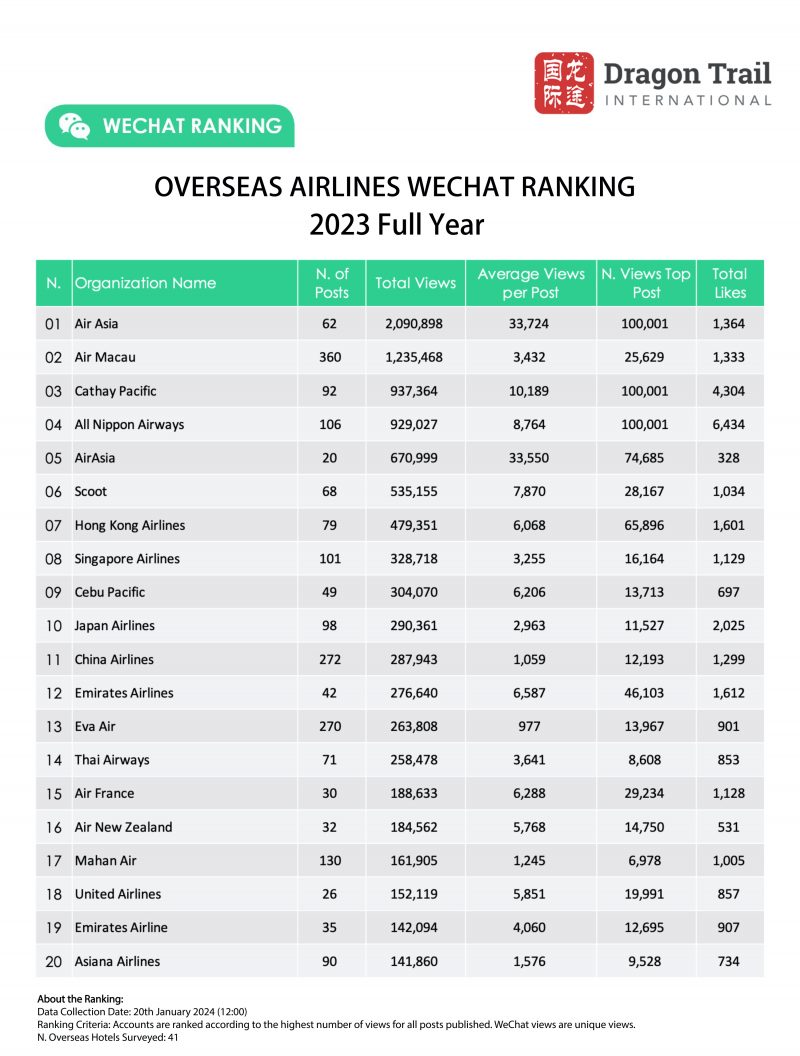

Airlines

In 2023, views of airlines content on WeChat experienced an increase as travelers made preparations for their holiday journeys. With an average of 5,027 views per post, marking a 48.42% growth compared to 2022, though still remaining below the pre-pandemic levels of 5,424 views per post in 2019.

WeChat posts by Cathay Pacific, Air Asia, and All Nippon Airways

The top three most-read airline articles of 2023 belonged to Cathay Pacific, Air Asia, and All Nippon Airways. These articles featured discounted flight tickets to various Asian countries, including Thailand, Malaysia, Philippines, Indonesia, Japan, etc. Predominantly, the most-viewed content in the airline category comprised promotional posts offering discounted flight tickets, primarily published during the first two quarters of the year.

Cruise Lines

Following the reopening of China’s international cruise market in June 2023, views of cruise line posts experienced a notable increase compared to 2022 figures (2,952 views), reaching 5,558 views in 2023, marking a 88.28% rise. The most-viewed posts predominantly originated from the third and fourth quarters of the year, often featuring discounted cruise tickets, announcements regarding the resumption of international cruise voyages in the country, and introductions to various cruise routes.

Royal Caribbean International garnered significant views and likes for its announcement of cruise operations resuming on May 15, 2024. Other renowned international cruise companies, including Viking Cruises and MSC Cruises, have also revealed intentions to recommence voyages from China. Noteworthy is the maiden voyage of “China Merchants Yidun,” a joint venture between China Merchants and Viking, marking the inaugural cruise ship to resume services.

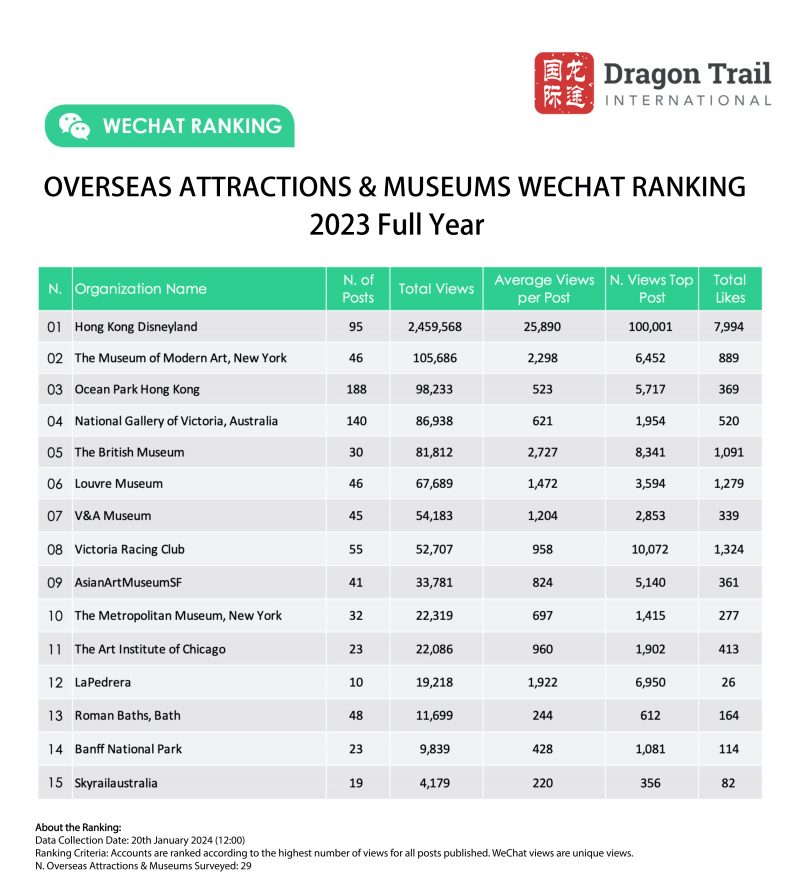

Museums & Attractions

Average views saw an increase of 64.59%, with Hong Kong Disneyland’s account contributing a 79% share of the total views in this category. Among the 34 highly read articles published by Hong Kong Disneyland, standouts included the announcement of the opening of the Frozen-themed park on November 20, 2023, a comprehensive guide to the 2023 Christmas celebrations, and highlights of special events and shows for “Princess Week”.

WeChat posts by Hong Kong Disneyland, MoMA, and Ocean Park Hong Kong

For museums, the most popular content included The British Museum’s exhibition “The Citi Exhibition: China’s Hidden Century”, MoMA’s curated collection showcasing “New Chinese Art”, and the Asian Art Museum SF’s exhibition featuring the Chinese painting “Six Persimmons” by Muqi.

Hotels

Suscríbase a nuestro boletín gratuito para mantenerse al tanto de las últimas noticias

NO COMPARTIMOS SU INFORMACIÓN CON TERCEROS. CONSULTE NUESTRA POLÍTICA DE PRIVACIDAD.

This website or its third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to the use of cookies.