Dragon Trail International’s Xiaohongshu Rankings Report tracks and analyzes performance for national tourism organizations (NTOs), destination marketing organizations (DMOs), airlines, cruise lines, museums & attractions, and hotels. The quarterly Xiaohongshu report builds industry benchmarks and uncovers best practices in digital marketing in the travel sector.

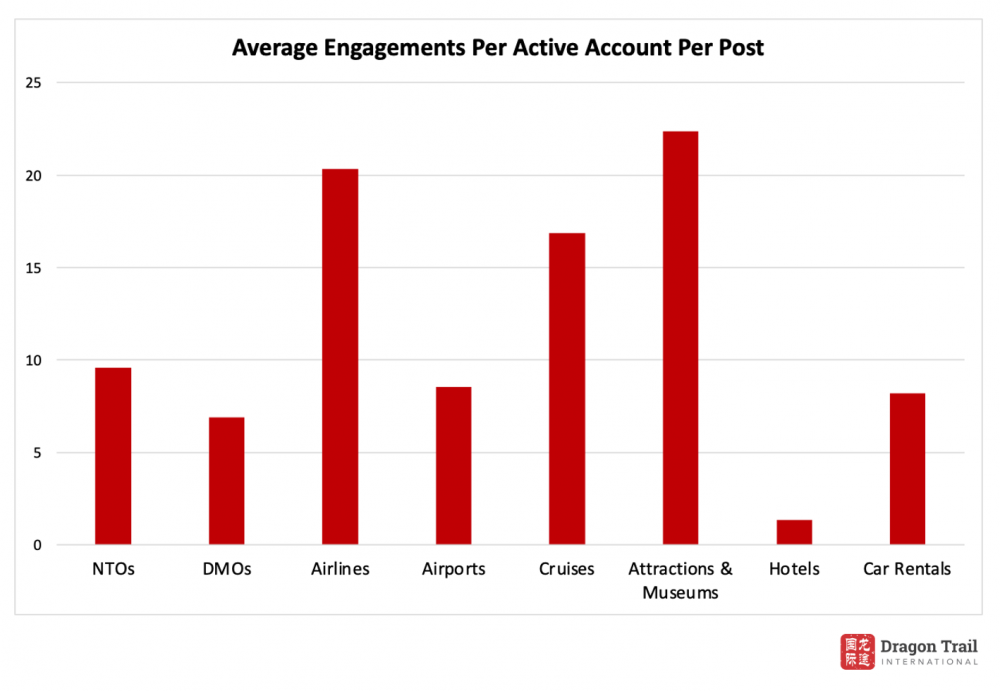

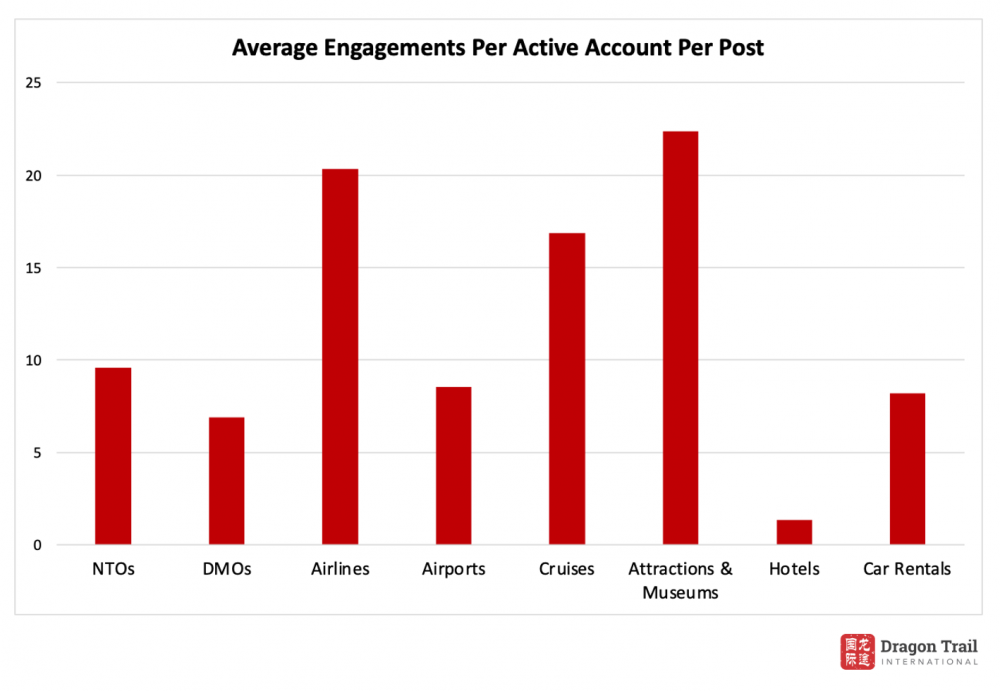

Engagement Rate Per Active Account Per Post

In Q1 2025, the Attractions & Museums category recorded the highest engagement per active account per post at 22.35, followed closely by Airlines at 20.35 and Cruises at 16.88. Hotels ranked lowest with only 1.34, indicating limited audience interaction despite account activity. Airports and Car Rentals maintained moderate performance at 8.54 and 8.18 respectively, while NTOs and DMOs achieved 9.58 and 6.88.

NTOs

Tourism Australia retained its top position in Q1 2025, a spot it has consistently held since Q1 2024. Compared to the same period last year, the organization more than tripled its total engagements—from 11,197 to 37,766—and saw its weekly engagement rate rise from 1.90% to 4.39%. Among the top-performing NTO accounts, four are based in Europe, three in Asia, and three in Oceania. Overall engagement in this category increased by 173%, rising from 33,307 in Q1 2024 to 90,899 in Q1 2025. The average engagement per active account per post also more than doubled, growing from 4.35 to 9.58.

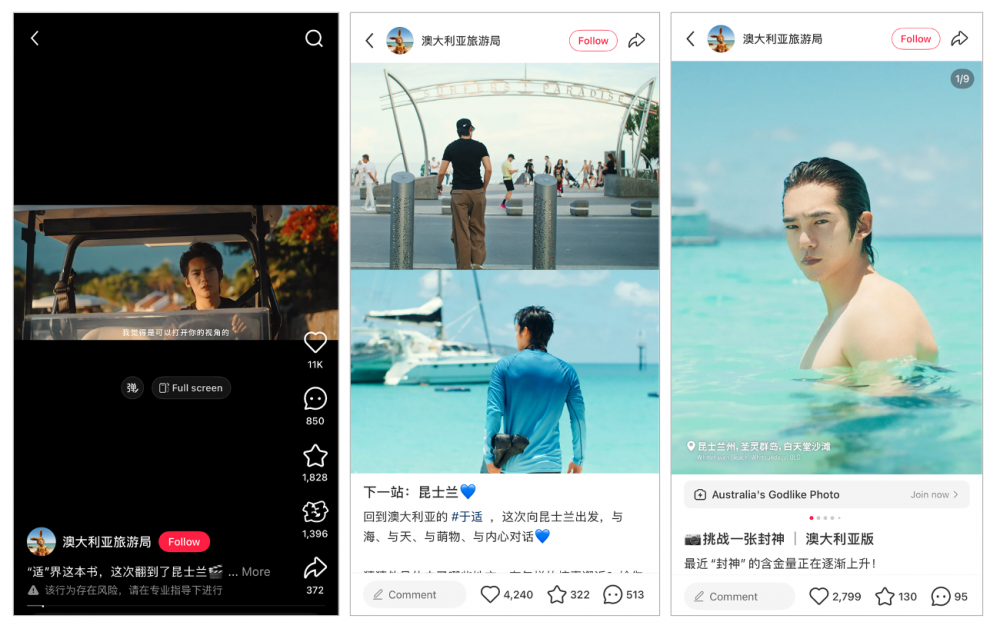

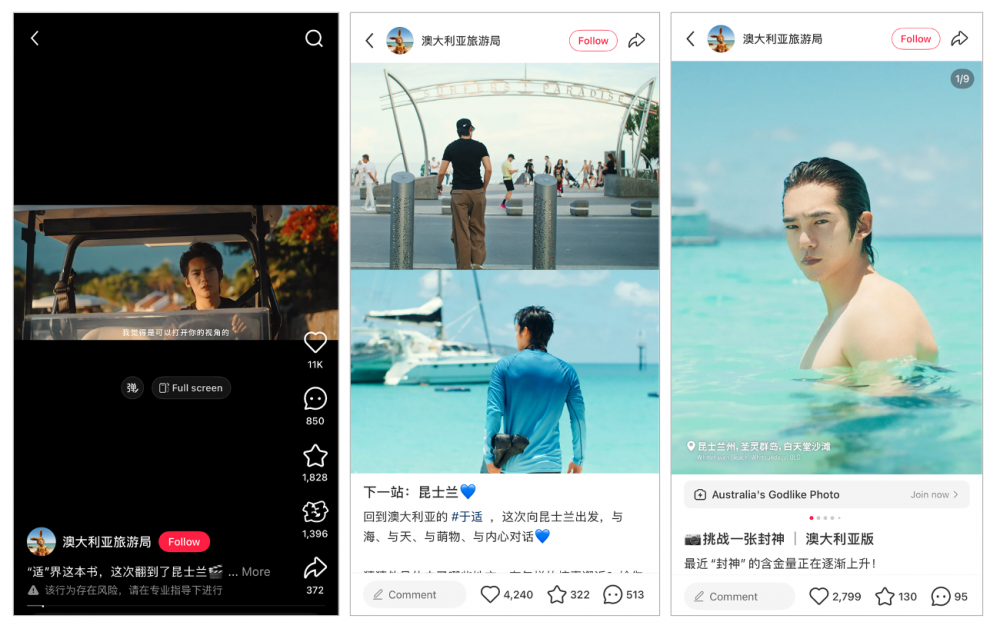

Tourism Australia accounted for seven of the top ten most popular posts, with the highest-performing content being a promotional video for Queensland featuring actor Yu Shi. Other widely shared posts focused on Yu Shi’s travel itinerary, highlighting destinations such as the Gold Coast, Great Barrier Reef, Currumbin Wildlife Sanctuary, Burleigh Heads, and Surfers Paradise. These posts encouraged audiences to follow his journey across Australia. Similar to its success on Weibo, Tourism Australia’s collaboration with Yu Shi significantly boosted the destination’s visibility and sparked widespread discussion among his fanbase. The campaign’s dedicated hashtag, #于适的昆士兰假期 (#YuShisQueenslandTrip), garnered 250.5K views and 10.8K notes. Destinations and activities featured in Yu Shi’s itinerary quickly became popular among fans and potential travelers.

Tourism Australia’s posts featuring Yu Shi

A standout post that ranked second in popularity was a short film by the Swiss Embassy in China celebrating the Year of the Snake. This follows a similar initiative from the Swiss National Tourist Office last year, which featured a short film and animation for the Year of the Dragon. The 2025 video proved especially successful, achieving 44,200 likes, 2,419 comments, and 2,032 saves as of April 2025.

DMOs

The Discover Hong Kong and Macau Government Tourism Office accounts continued to dominate the DMO category in Q1 2025, securing the top two positions for total engagement since Q4 2023. Together, these two accounts accounted for almost half of the category’s total engagements.

Notably, Visit Queensland rose to third place in Q1 2025, achieving a remarkable 26,530 total engagements and a weekly engagement rate of 67.84%, representing a 346% increase compared to Q4 2024. This surge in popularity was primarily driven by content related to actor Yu Shi, which generated substantial traffic for both the account and the destination.

The most popular DMO post in Q1 2025 came from Discover Hong Kong, promoting singer Hua Chenyu’s new song, Tipping Point, while evoking memories of his time in the city. Macau’s most popular post featured a 9-minute video of Hendery (Huang Guanheng) showcasing local restaurants, attractions, and experiences—a strategy that resonates well with fans who are likely to follow in the celebrity’s footsteps, potentially converting interest into tourism. The third most popular post, shared by Edinburgh, featured a video of people from diverse backgrounds offering New Year wishes.

Although Chinese New Year is China’s most important traditional holiday, celebrity-driven content continues to outperform holiday-themed posts on Xiaohongshu. The most engaging content in the DMO category during Q1 2025 predominantly featured well-known actors and musicians, underscoring the strong influence of celebrity marketing in destination promotion.

Airlines

AirAsia dominated the airlines category in Q1 2025, achieving 49,346 total engagements and accounting for 42.32% of the category’s overall engagement. It was followed by Asiana Airlines and Cathay Pacific. Total engagements in the category increased significantly, rising from 19,379 in Q1 2024 to 116,596 in Q1 2025—a 502% increase. The average engagement per active account per post also grew from 6.99 to 20.35, representing a 191% rise.

As the top-performing airline account, AirAsia produced a diverse range of content, including dining recommendations, celebrity collaborations, cabin meal features, dance challenges, and promotional campaigns. Its most popular post was an official announcement introducing emerging artist Bo Yuan as AirAsia’s “Brand Friend”. Other well-received posts featured “Brand Friends” such as singer-songwriter Zhang Yanqi and the musical duo Landlord Cat. Additionally, singers Yu Jiayun and Tang Hanxiao were appointed as “Brand Music Friends.”

Popular posts from AirAsia featuring its “Brand Friends” and “Brand Music Friends”

Popular posts from AirAsia featuring its “Brand Friends” and “Brand Music Friends”

This campaign resonated particularly well with young audiences, as the collaboration with rising talents in the Chinese music industry aligned closely with AirAsia’s youthful and dynamic brand image. Notably, AirAsia’s founder also serves as the CEO of Warner Music Malaysia, enabling strategic partnerships that infuse the brand with a creative and artistic identity. The hashtag #AirAsiasPlaylist became a trending topic on Xiaohongshu, further amplifying the campaign’s impact. These collaborations went beyond traditional brand promotion, enriching and expanding the brand’s cultural relevance and emotional connection with audiences.

Other top-performing content in the category included Asiana Airlines’ fan giveaways and Cathay Pacific’s promotion of a stage performance in partnership with Wing Chun.

Airports

All tracked airport accounts remained active in Q1 2025, collectively generating 33,484 engagements with an average engagement rate of 7.15%. The average engagement per active account per post was 8.54, indicating moderate performance compared to other categories. Singapore Changi Airport led the category, contributing 27.74% of total engagements, followed by London Heathrow Airport and Paris Airport.

The most popular post, from Singapore Changi Airport, featured a guide to the airport’s top five most photogenic spots, accompanied by a survey and lucky draw to engage participants. Paris Airports ranked second with a video of Extime Ambassador Lijun Chen sharing Lunar New Year greetings at UNESCO’s Spring Festival celebration, promoting China–France cultural exchange. The third most popular post came from London Heathrow Airport, highlighting the airport’s retail offerings and passenger experiences through a promotional video.

Chinese New Year emerged as a key theme across airport accounts, reflecting travel patterns of overseas Chinese returning home or traveling abroad for the holiday season. Compared to other categories, airport accounts have a more prominent focus on this occasion due to their direct connection to international travel and passenger flow during peak holiday periods. Airports serve as key transit hubs for family reunions and outbound tourism, making Lunar New Year an ideal opportunity to engage travelers with festive content, cultural elements, and promotions that resonate with their travel motivations.

Cruise Lines

The total engagements in the cruises category declined by 18% from Q4 2024 to Q1 2025, and the average engagement per active account per post fell from 26.22 to 16.88, marking a 35.63% drop.

Royal Caribbean led the category, contributing 71.5% of total engagements. Eight of the ten most popular posts originated from Royal Caribbean and primarily featured fan giveaways and KOL cruise vlogs. Additional content included practical guides on topics such as Wi-Fi packages, room types, and cruise itineraries.

Attractions & Museums

The attractions category recorded the highest engagement rate per active account per post, reaching 22.35. This marks a 60% increase from 13.96 in Q4 2024.

Hong Kong Disneyland maintained its leading position, accounting for 63% of the category’s total engagements. Its engagement volume nearly doubled compared to Q4 2024, significantly contributing to the overall growth in the category. Seven of the top ten most popular posts came from Hong Kong Disneyland, with the most engaging content being a stop-motion animation featuring Duffy and Friends—one of the most beloved Disneyland IPs in China. Other high-performing posts highlighted the park’s 20th anniversary celebrations, Women’s Day greetings from Disney characters, and a Chinese New Year stop-motion video also featuring Duffy and Friends.

Among museums, M+ Museum ranked second after Hong Kong Disneyland, generating 15,515 engagements and averaging 554 engagements per post. Its most popular post featured a video introduction of Jessie Yip, the Senior Creative Commercial Content Specialist at M+.

Hotels

Among all categories, hotel accounts recorded the lowest engagement per account per post, averaging only 1.34. Despite most accounts remaining active throughout the quarter, only 11 out of 39 surpassed 1,000 total engagements in Q1 2025.

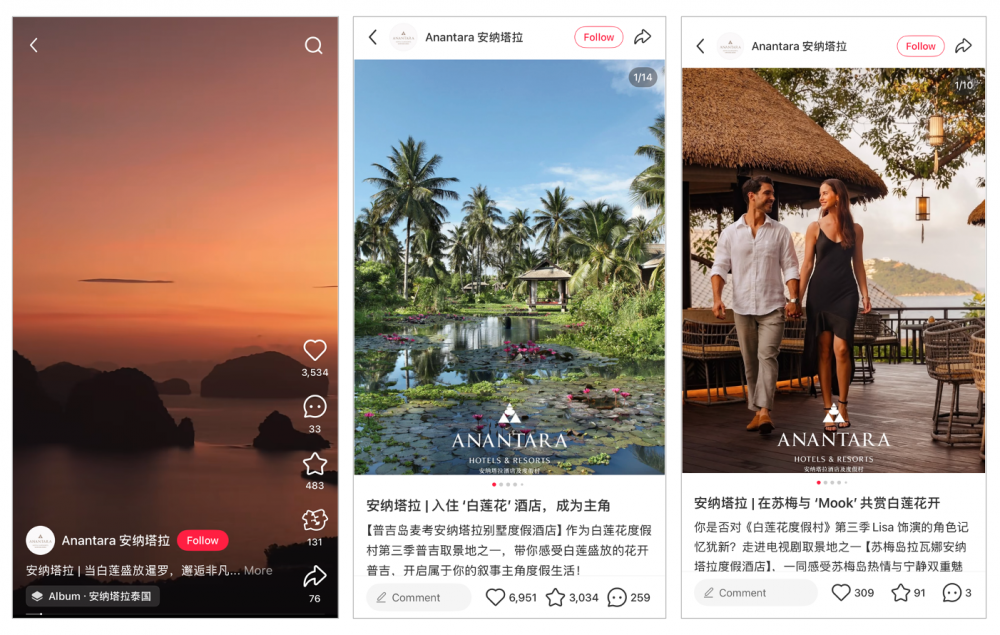

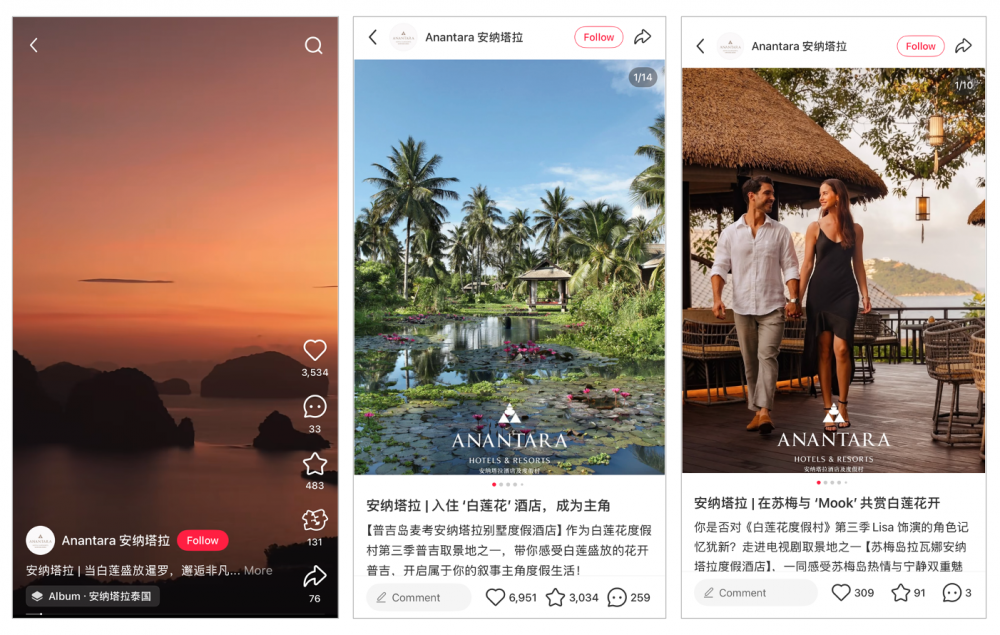

Anantara ranked first in the hotel category for the first time since Q4 2023, accounting for 23.32% of total engagements and averaging 428 engagements per post. This significant increase was largely driven by the popularity of the television series The White Lotus, which featured the Anantara resort in Phuket as one of its filming locations. Anantara effectively leveraged the show’s popularity by incorporating relevant keywords, scenes from the series, and the concept of a “White Lotus-style” vacation into its marketing content. For example, its most popular post is a cinematic video featuring symbolic elements from the series, such as the civet and traditional Thai mural art, set to an orchestral soundtrack. The caption promotes not only the Phuket resort but also other Anantara properties across Thailand, inviting travelers to embark on a rejuvenating journey centered on wellness and transformation.

Anantara’s promotional posts, leveraging the popularity of the TV series The White Lotus to boost engagement

Anantara’s promotional posts, leveraging the popularity of the TV series The White Lotus to boost engagement

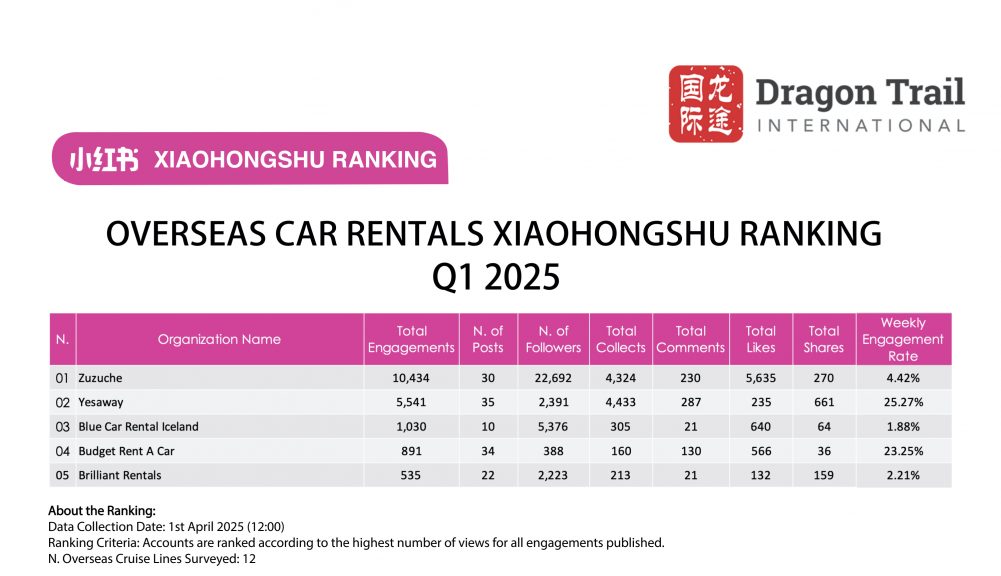

Car Rentals

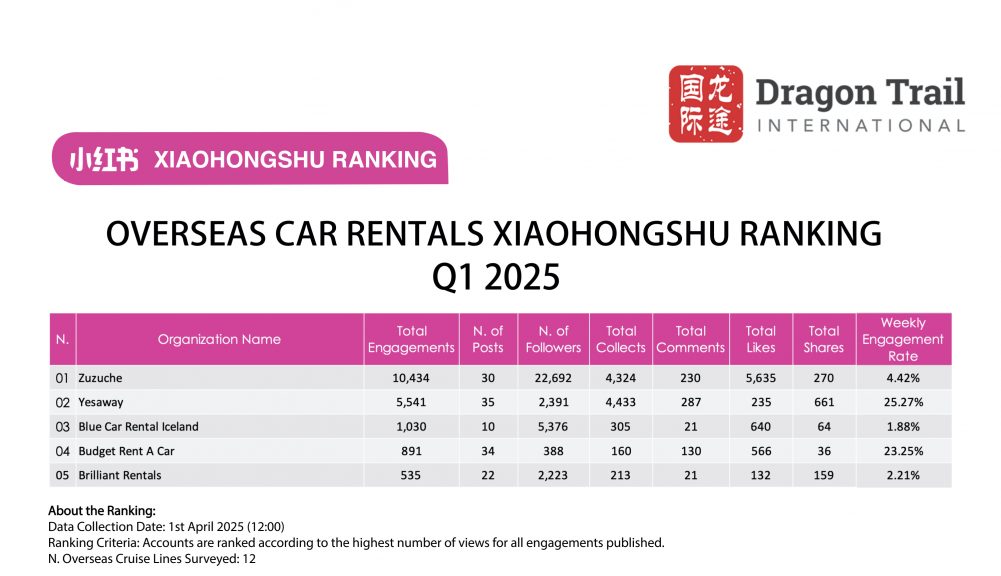

Zuzuche led the car rental category in Q1 2025, accounting for 52% of total engagements and averaging 347.8 engagements per post, followed by Yesaway and Blue Car Rental Iceland.

Zuzuche recorded the highest engagement in Q1 2025, reaching a total of 8,544 engagements as of April. Its most popular video, titled “The Truth Behind Internet Attractions,” highlights discrepancies between online portrayals and the reality of popular tourist spots, such as the sea of pink muhly grass in Hangzhou, Farsha Mountain Lounge in Sharm el-Sheikh, and the Ik Kil Cenote in Yucatán. The brand’s content centers around the theme “Internet vs. Reality,” offering candid reviews of attractions rather than focusing solely on car rental services. This content strategy has proven highly effective in driving engagement. By capturing the attention of travelers researching destinations, Zuzuche indirectly promotes car rentals as a practical and flexible option for exploring these locations firsthand.

Popular posts from AirAsia featuring its “Brand Friends” and “Brand Music Friends”

Popular posts from AirAsia featuring its “Brand Friends” and “Brand Music Friends”

Anantara’s promotional posts, leveraging the popularity of the TV series The White Lotus to boost engagement

Anantara’s promotional posts, leveraging the popularity of the TV series The White Lotus to boost engagement